US dollar Price Analysis: DXY bulls pushing the barriers

- US dollar reaches into the 110 area and bulls remain in control.

- The bears need to get back below 108.90 structure for the days ahead.

Following on from last week's positive close, it has been a bullish start for the week in the greenback. The US dollar has touched 110 in trade to start the week but the Shark harmonic pattern remained as a bearish feature on the charts.

DXY H4 chart

The price will need to get below the 108.90s for prospects of a deeper run through the 108's and to offer some relief, if only temporary, within the firm bullish cycle in the greenback.

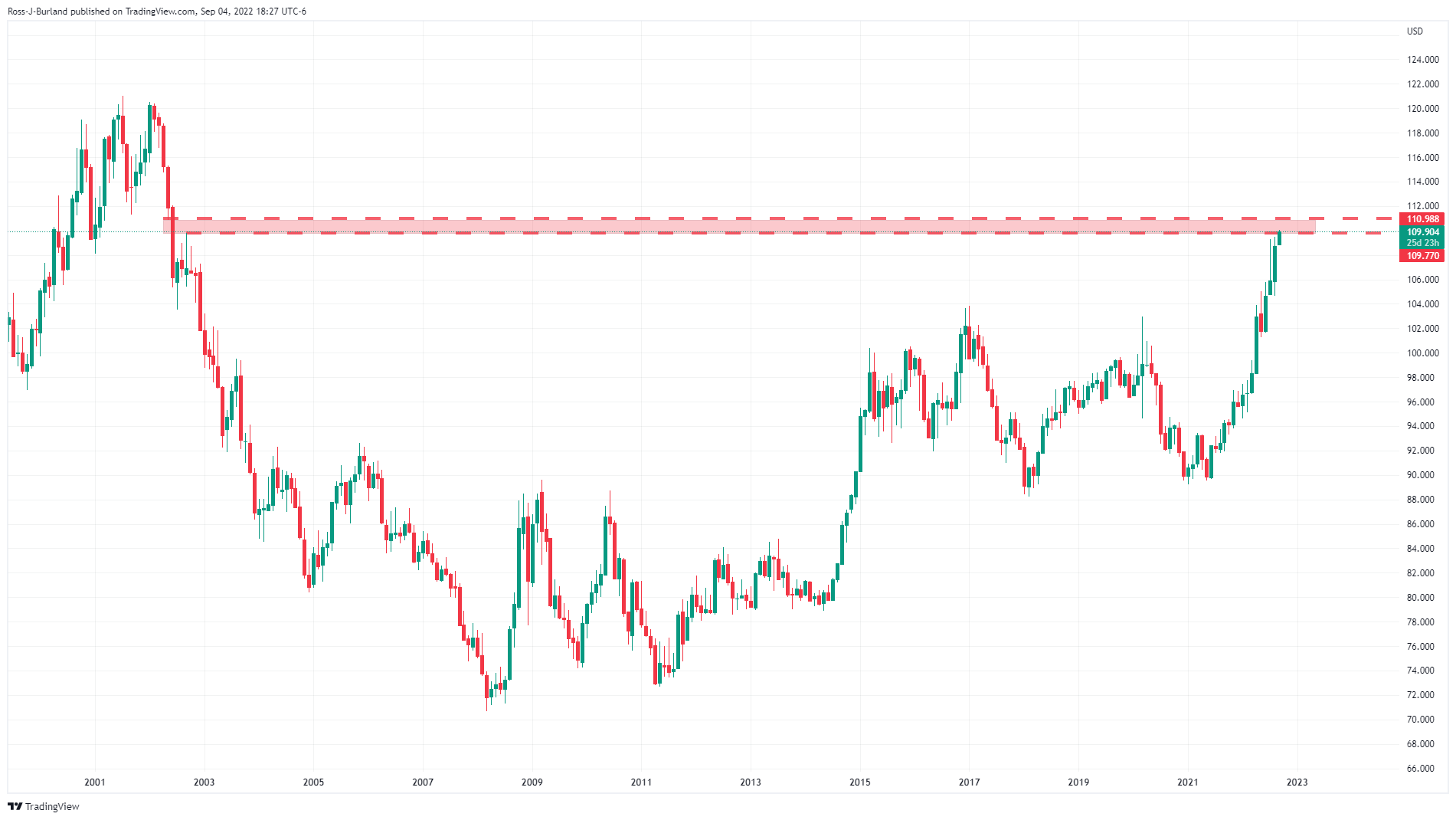

With that being said, there is room for the index to run until it meets January 2002 lows at 110.98:

DXY monthly chart

As illustrated, there is room to go to the upside given the gap that could be filled in the month ahead, if not days or weeks. Volatility in the forex space has picked up over the course of 2022 and especially into the summer months:

As per CNBC's DBCVIX USD Volatility Index, August has seen a pick up in volatility which could be just getting started.