Back

20 May 2022

Crude Oil Futures: Correction lower on the table

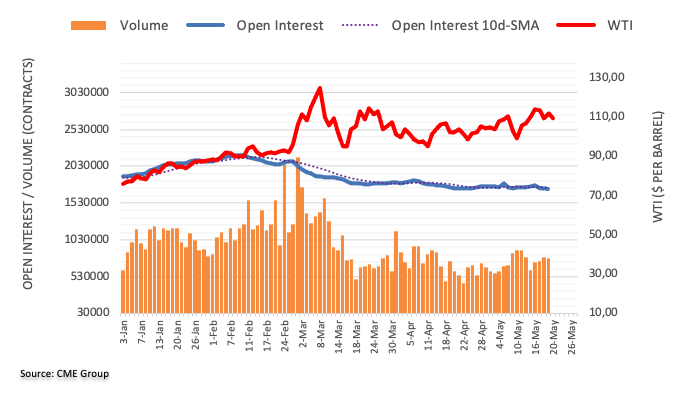

CME Group’s flash data for crude oil futures markets noted traders trimmed their open interest positions by around 8.3K contracts on Thursday, clinching the third consecutive daily drop. Volume followed suit and dropped by around 11.6K contracts after three daily pullbacks in a row.

WTI could still test $116.60

Prices of the WTI reversed two straight declines on Thursday. The move, however, was fuelled by short covering as showed by diminishing open interest and volume. Against that, a corrective downside should not be ruled out in the very near term, while the March 24 high at $116.60 still caps the upside.