US Dollar Index regains composure near 92.50, focus on COVID, data

- The index partially reverses Friday’s sharp pullback around 92.50.

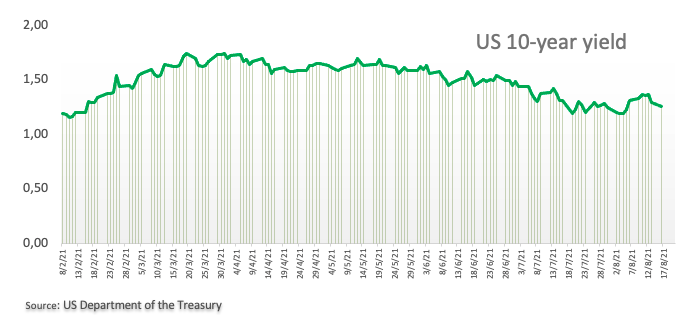

- US 10-year yields bounce off recent lows in the 1.25% region.

- TIC Flows, Empire State Index next on tap in the US docket.

The greenback, when gauged by the US Dollar Index (DXY), regains the smile somewhat and gyrates around the 92.50 area at the beginning of the week.

US Dollar Index propped up by data, COVID concerns

The index manages to pick up some upside traction and leave behind Friday’s important retracement on the back of perseverant coronavirus concerns (mainly stemming from the advance of the Delta variant across the world) and the softer tone in the risk complex.

In fact, lower-than-expected data results in the Chinese docket released earlier on Monday poured some cold water over growth prospects and hurt the demand for riskier assets following last week’s rally, which saw new highs in the US markets.

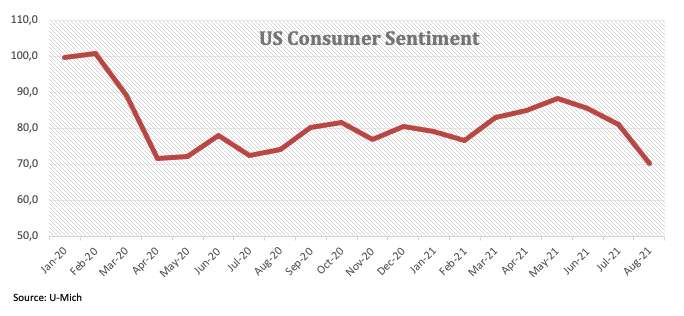

The uptick in the dollar comes despite yields of the key US 10-year note remain depressed in the lower end of the recent range, particularly in the wake of the sharp drop to a decade-low in the preliminary US Consumer Sentiment for the month of August, as per the U-Mich Index published at the end of last week.

Moving forward, the NY Empire State Index comes next in the calendar seconded by TIC Flows during June.

What to look for around USD

DXY managed to re-test the area of July peaks around 93.20 during last week, although the move lacked follow through and a moderate corrective downside to the mid-92.00s soon followed. The dollar appears under pressure after the latest FOMC meeting saw the Committee talking down the probability of QE tapering in the near term despite the upbeat, albeit so far insufficient, progress of the US economy (and the consensus among investors). In the meantime, fresh coronavirus concerns, the solid pace of the economic recovery, high inflation and prospects of earlier-than-expected QE tapering/rate hikes should remain key factors supporting the dollar for the time being vs. the reflation trade, which is expected to keep propping up the risk complex.

Key events in the US this week: Retail Sales, Industrial Production, NAHB (Tuesday) – Building Permits, Housing Starts, FOMC Minutes (Wednesday) – Initial Claims, Philly Fed Index, CB Leading Index (Thursday).

Eminent issues on the back boiler: Biden’s multi-billion plan to support infrastructure and families. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Debt ceiling debate. Potential hint at QE tapering at the Jackson Hole Symposium.

US Dollar Index relevant levels

Now, the index is gaining 0.07% at 92.58 and a break above 93.19 (monthly high Aug.11) would open the door to 93.43 (2021 high Mar.21) and finally 94.00 (round level). On the other hand, the next support emerges at 92.12 (50-day SMA) followed by 91.78 (monthly low Jul.30) and finally 91.51 (weekly low Jun.23).