EUR/USD Forecast: The 1.1850 area holds the downside… for now

- EUR/USD fades part of Monday’s advance beyond 1.1900.

- So far, solid support emerged in the mid-1.1800s.

- The pair remains in oversold territory (RSI < 30).

The weekly recovery in EUR/USD seems to have run out of legs in the 1.1920 for the time being, as the better tone in the risk appetite looks insufficient to push spot further north.

Ideally, the pair needs to surpass this area of recent tops to mitigate some downside pressure, although the improved sentiment in the dollar post-FOMC event is still expected to keep the positive stance around the buck for yet some time.

The upside in German yields has collaborated with the better note in the European currency, although, once again, this seem to be not enough to reverse the sharp selloff seen in past sessions.

It is all about the dollar now, inflation and the timing of the Fed’s tapering, as market participants look to have already priced in the strong rebound of the economic activity in the region along with the re-opening of the economy and the improved pace of the vaccination campaign.

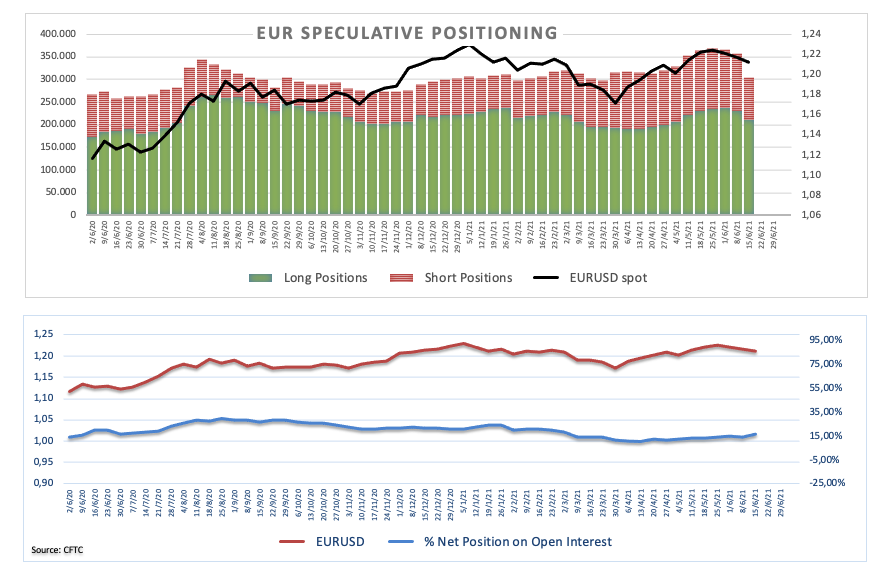

On the specs front, the latest CFTC report (Monday) showed an important drop in EUR goss longs and shorts, still keeping the net position in levels last seen in early March and still showing how crowded that trade is.

However, the still oversold condition of EUR/USD, as per the daily RSI (26.86), hints at the idea that we could still witness some bullish attempts in the very near term.

That said, there is a couple of minor resistance levels to be considered, both at Fibo retracements at 1.1887 and 1.1976 and ahead of the more significant hurdle at the critical 200-day SMA, today at 1.1992. Further north comes in the psychological yardstick at 1.20 the figure. Above the 200-day SMA, the selling pressure is expected to mitigate somewhat.