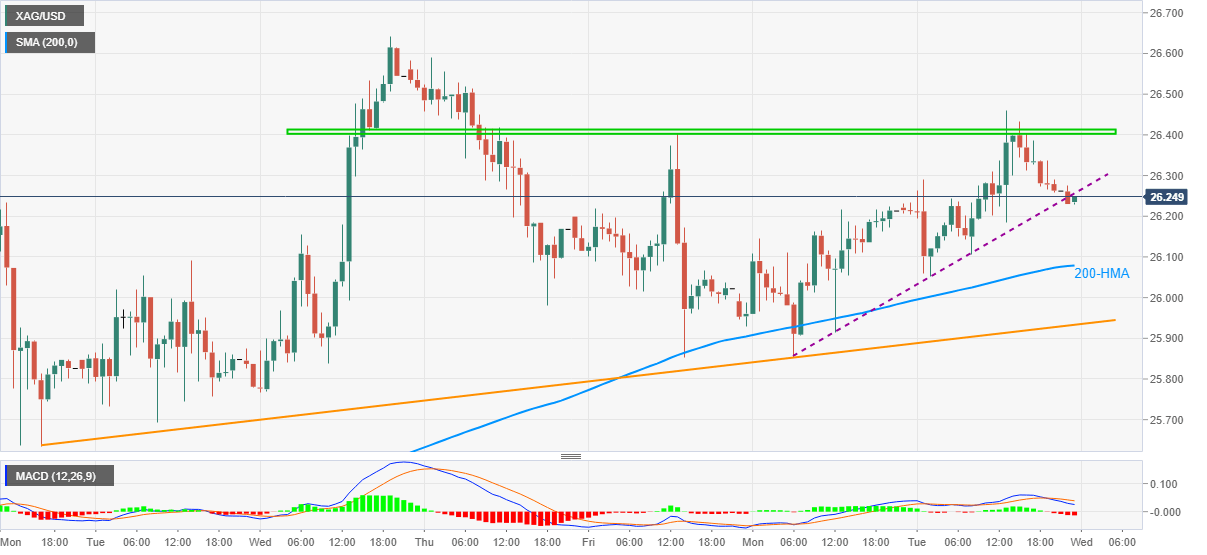

Silver Price Analysis: XAG/USD looks set to retest $26.00 on weekly support break

- Silver prices stay depressed around intraday low, print mild losses.

- Bearish MACD joins trend line breakdown to direct sellers toward 200-HMA.

- $26.40-45 adds to the upside filters, seven-day-old rising support line can test the bears.

Silver remains depressed around intraday low while flashing $26.24, down 0.09% on a day, during Wednesday’s Asian session. In doing so, the white metal slips below an ascending trend line from Monday.

With the bearish MACD joining the trend line breakdown, silver prices seem to remain weak, highlighting 200-HMA near $26.00 as immediate support.

However, any further weakness past-$26.00 will need to break an upward sloping support line from April 19, around $25.90, to keep the silver bears hopeful.

Meanwhile, corrective pullback beyond the previous support line, now adjacent resistance near $26.30, isn’t an open invitation to the silver bulls as multiple levels, marked since Monday, could test the commodity’s upside moves near $26.45.

In a case where the bullion stays positive beyond $26.45, the monthly top near $26.65 will be the key to follow.

Silver hourly chart

Trend: Further weakness expected