Gold Price Analysis: XAU/USD daily support is important for the open

- Gold prices could be on the verge of a bearish head and shoulders on the 4-hour time frame.

- Daily support will be critical for the open this week.

Gold dropped from six-week highs early on Friday with the US yield on the 10-year Treasury note shooting higher which ended the day up by 3.2%.

For the open, the Technical conditions are compelling.

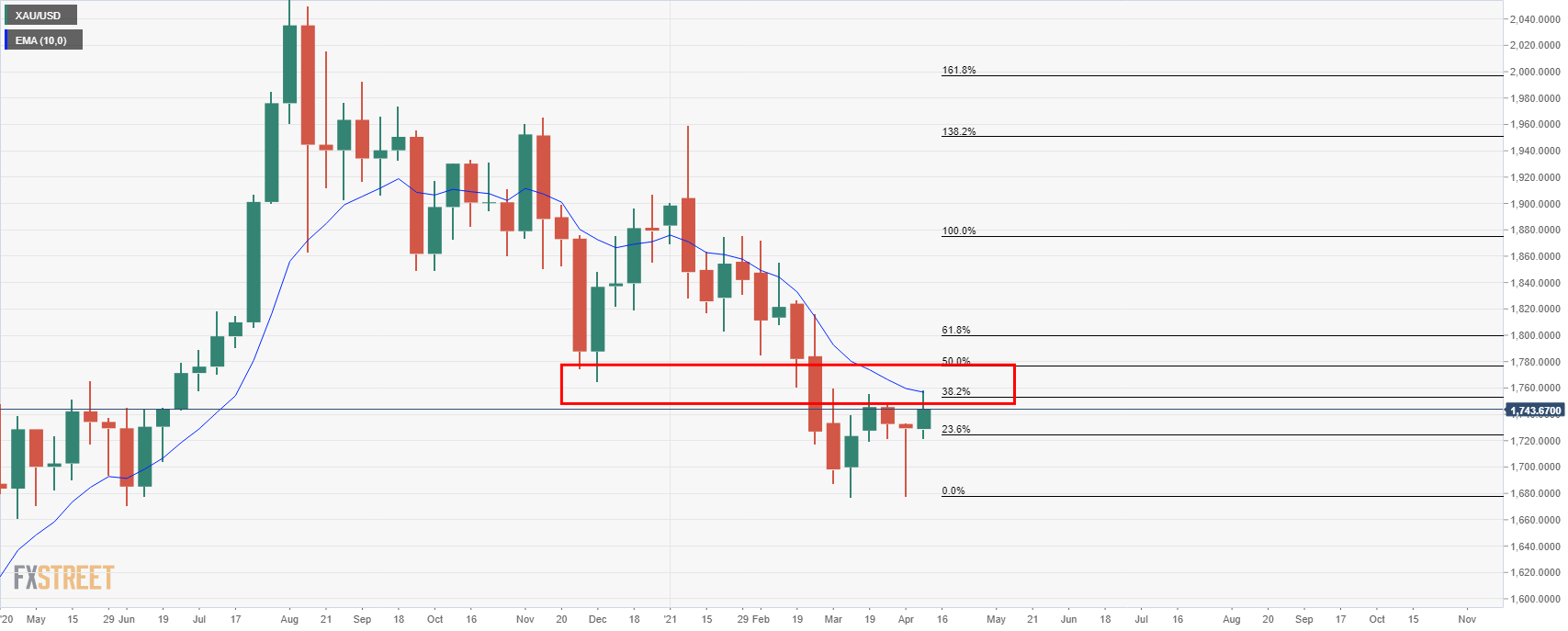

The price has been correcting the weekly bearish impulse in a 38.2% Fibonacci retracement where it meets the 10 EMA.

However, the bullish weekly close leaves the precious metal poised for an upside continuation for the week ahead from daily support:

If, however, the price breaks the daily support, $1,725 will be in focus again on the downside.

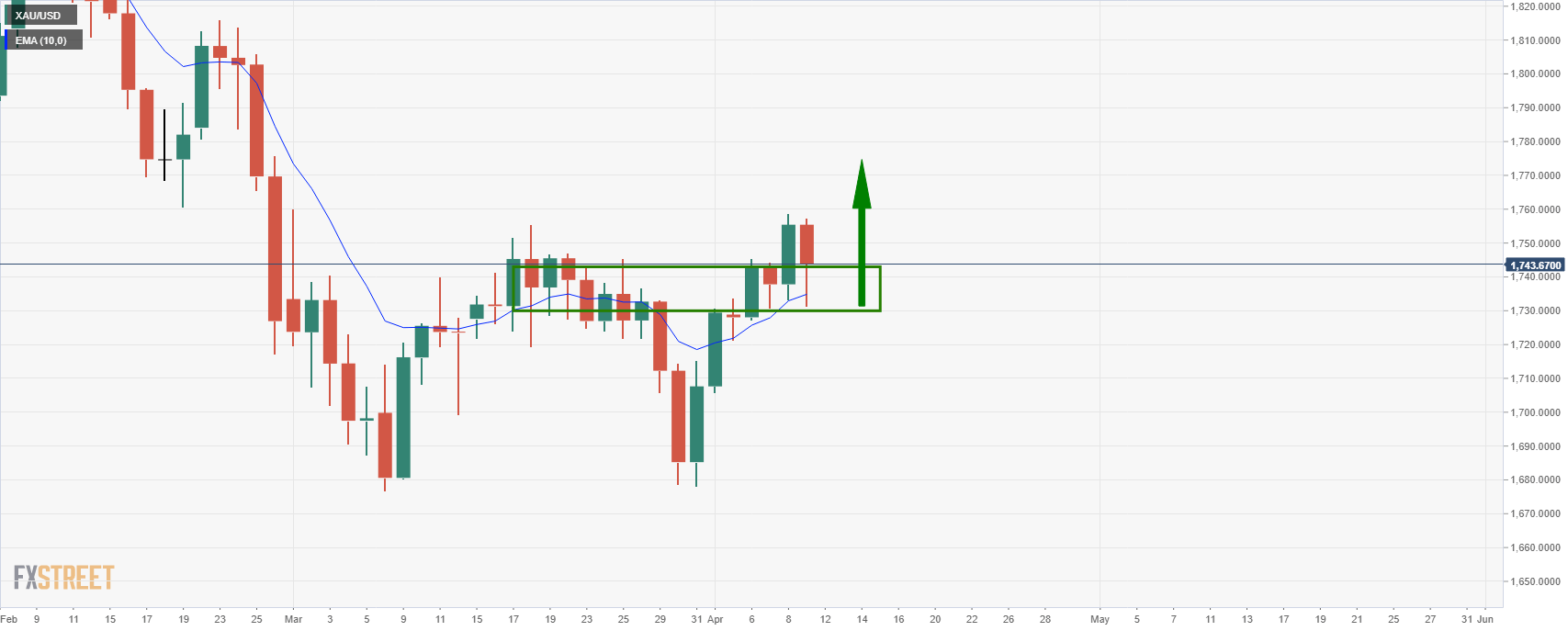

As it stands, the 4-hour chart is bearish with the price smothered by the 10 and 20 EMAs starting to close their distance.

There has been a 50% mean reversion of the bearish impulse already, so if selling pressures emerge, $1,735 will be critical guarding the downside.

If $1,735 holds, there are prospects of a bearish head and shoulders formation: