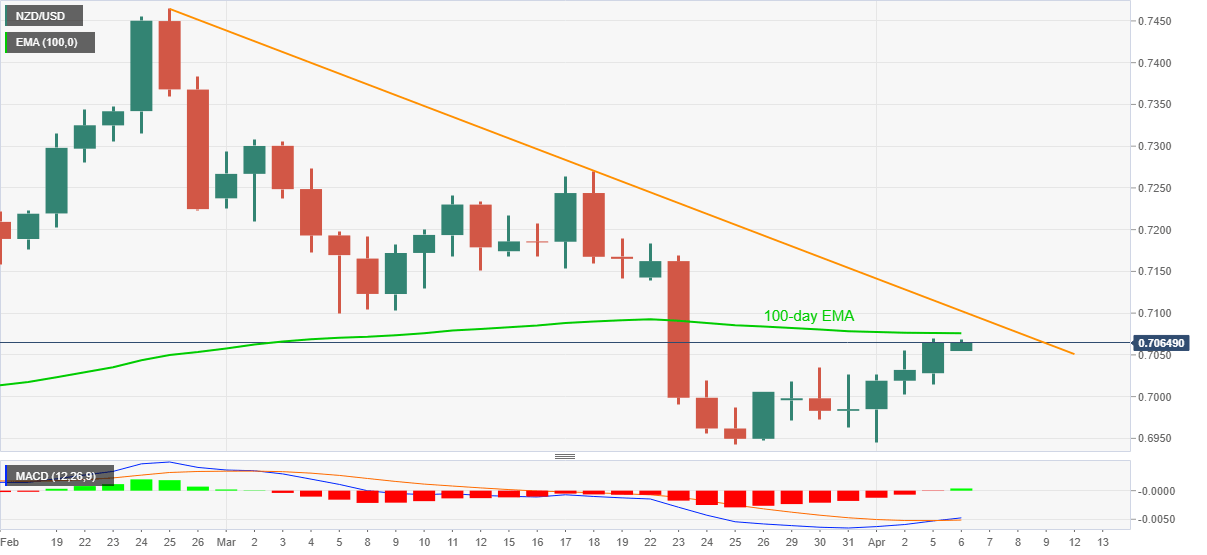

NZD/USD Price Analysis: Bulls barrel 100-SMA amid strongest MACD since February 26

- NZD/USD takes the bids near intraday high, up for fifth consecutive day.

- Upbeat MACD suggests clearance of nearby SMA hurdle but the key resistance will test the bulls.

- Sellers need sustained weakness below 0.7020 for fresh entries.

NZD/USD stays firm around two-week top of 0.7070, up 0.16% intraday, amid Tuesday’s Asian session. In doing so, the kiwi pair justifies strong MACD signals to direct buyers toward 100-day EMA.

Although the highest bullish bias since late February favors NZD/USD upside to the 100-day EMA level of 0.7075, a downward sloping trend line from February 25, near 0.7105, will be the key to watch afterward.

In a case where NZD/USD crosses the 0.7105 hurdle on the daily closing, the 0.71200 threshold and March 18 high near 0.7270 should return to the charts.

On the flip side, multiple supports around 0.7020 can probe NZD/USD sellers before directing them to the 0.7000 psychological magnet.

However, a sustained weakness past-0.7000 can make the kiwi pair vulnerable to refresh multi-day low below 0.6943.

Overall, NZD/USD remains under the buyers’ arms but the consolidation of the recent gains can’t be ruled out.

NZD/USD daily chart

Trend: Further upside expected