Silver Price Analysis: XAG/USD drops to over one-week lows, around mid-$25.00s

- XAG/USD met with some heavy supply on Monday and confirmed a rising wedge breakdown.

- The metal now seems vulnerable to test monthly lows before dropping to 200-DMA support.

Silver witnessed some heavy selling on the first day of a new trading week and dropped to over one-week lows, around mid-$25.00s heading into the European session.

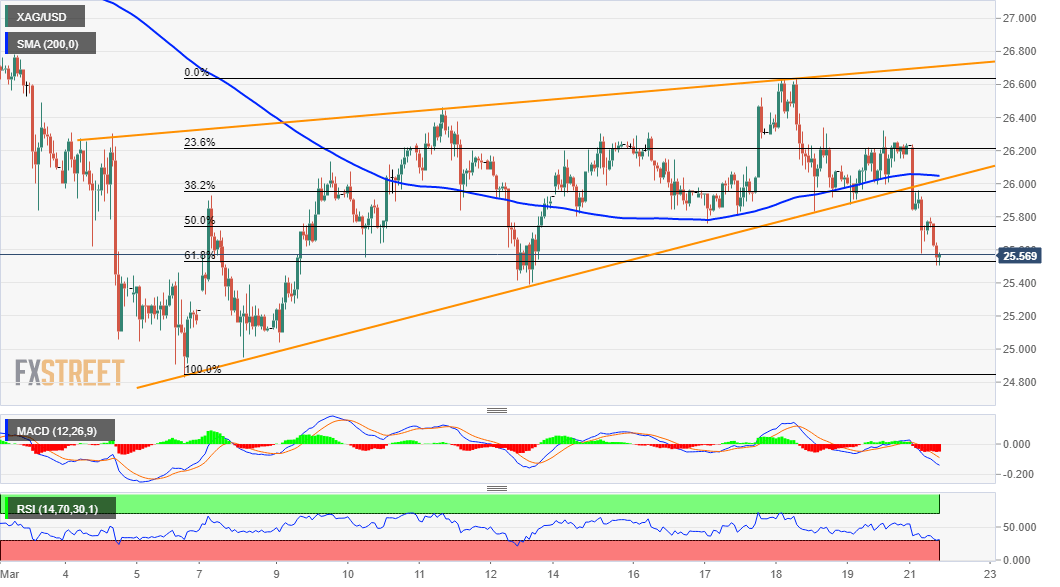

The sharp fall dragged the XAG/USD further below a confluence support near the $26.00 mark, which, in turn, might have prompted some aggressive technical selling. The mentioned level comprised of 200-hour SMA and a short-term ascending trend-line, which constituted the formation of a bearish rising wedge on hourly charts.

A convincing break through the pattern support marked a bearish breakdown and might have already set the stage for a further near-term depreciating move. The bearish outlook is reinforced by the fact that oscillators on hourly/daily charts have been gaining drifting lower and are still far from being in the oversold zone.

Some follow-through weakness below the 61.8% Fibonacci level of the $24.92-$26.64 recent positive move will reaffirm the bearish bias and turn the XAG/USD vulnerable to slide further. The next relevant bearish target is pegged near the $25.20-15 region ahead of monthly swing lows, around the $24.80-85 region touched on March 5.

The downward trajectory could further get extended towards challenging the very important 200-day SMA support, around mid-$24.00s. The XAG/USD could eventually drop to retest YTD swing lows, near the $24.00 round-figure mark.

On the flip side, the $26.00 confluence support breakpoint might now act as a strong resistance. Any recovery attempt beyond the support-turned-resistance might be seen as an opportunity to initiate fresh bearish positions. This, in turn, should keep a lid on any further gains for the XAG/USD near the $26.30-35 heavy supply zone.

XAG/USD 1-hourly chart

Technical levels to watch