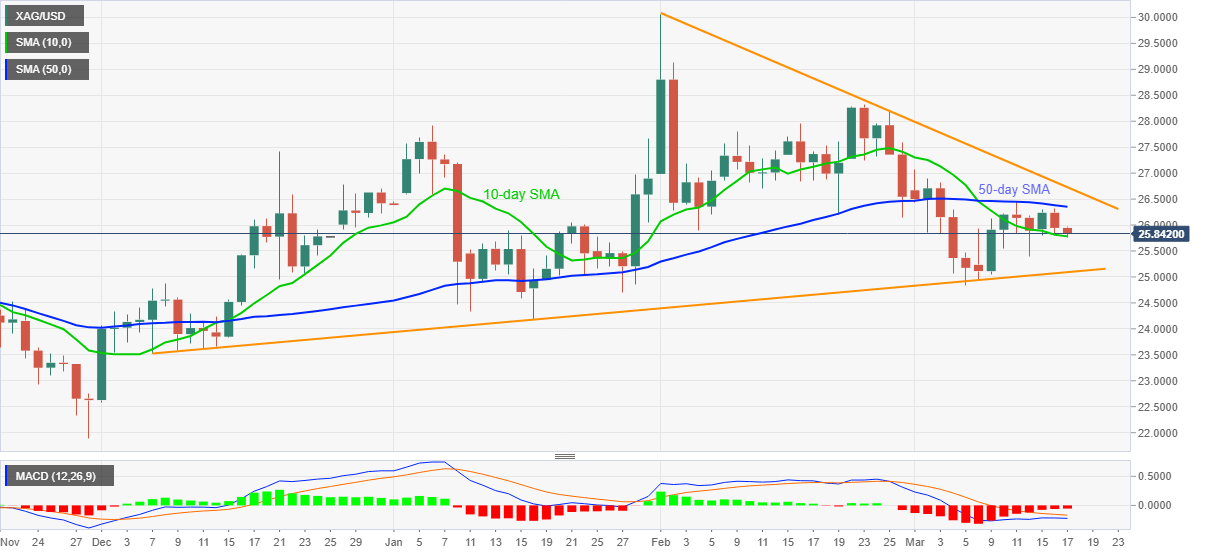

Silver Price Analysis: 10-day SMA probes XAG/USD bears eyeing key support line

- Silver stays depressed around short-term key SMA support.

- Bearish MACD, sustained trading below 50-day SMA favor sellers.

- 1.5-month-old falling trend line adds to the upside barriers.

Silver refreshes intraday low to $25.76, currently down 0.43% on a day near $25.85, during Wednesday’s Asian session. In doing so, the white metal extends the previous day's downbeat performance while staying below 50-day SMA for two consecutive weeks after declining below the same on March 03.

Even so, silver sellers battle intermediate support, 10-day SMA near $25.75, to the key rising trend line from December 07, at $25.09 now.

Should the commodity breaks the key support line, the $25.00 and the monthly low of $24.83 can act as buffers during the further downtrend.

Meanwhile, the corrective pullback may eye the 50-day SMA level of $26.35 as an immediate hurdle ahead of pushing the silver bulls towards the crucial resistance line from February 01 near $26.75.

Overall, silver’s sustained trading below important SMA and bearish MACD favor sellers to eye further losses.

Silver daily chart

Trend: Bearish