Copper Price Today: Risks further downside amid a potential rising channel

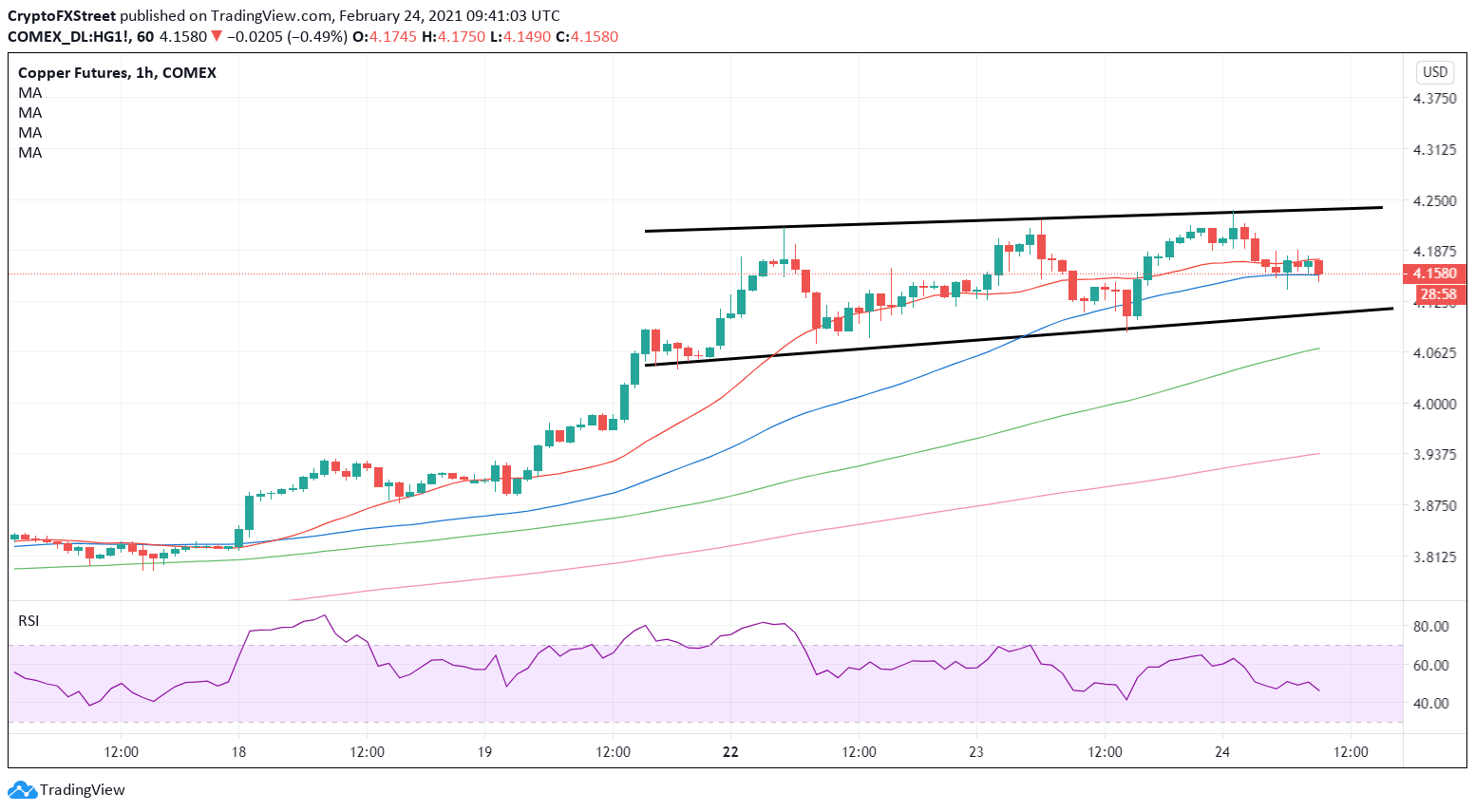

- Copper price could see a rising channel breakdown on the 1H chart.

- Acceptance below 50-HMA support is critical for the red metal bears.

- RSI stays bearish, points to further downside in the offing.

The price of copper (futures on Comex) is looking to extend its correction from nine-and-a-half year highs reached $4.2365 in early Asia.

In doing so, the red metal is eyeing a sustained move below the horizontal 50-hourly moving average (HMA) at $4.16.

Sellers need acceptance below the latter to unleash more losses, with the rising channel support at $4.1055 on their radars.

A channel breakdown will get validated on an hourly closing below that support, opening floors towards the upward-sloping 100-HMA at $4.0675.

Price of copper: Hourly chart

Alternatively, if the copper bulls manage to resist above the 50-HMA, the price could bounce back towards $4.20.

Further up, the channel barrier at $4.2395 will get tested, as the buyers clinch fresh decade highs.

The relative strength index (RSI) points south while below the midline, suggesting that there is more room to the downside.