When is the German IFO survey and how it could affect EUR/USD?

The German IFO Business Survey Overview

The German IFO survey for January is due for release later today at 0900 GMT. The headline IFO Business Climate Index is seen a tad lower at 92.0 versus 92.1 previous.

The Current Assessment sub-index is expected to drop to 90.7 this month vs. 91.3 prior while the IFO Expectations Index – indicating firms’ projections for the next six months – is likely to arrive at 93.2 in the reported month vs. 92.8 last.

Deviation impact on EUR/USD

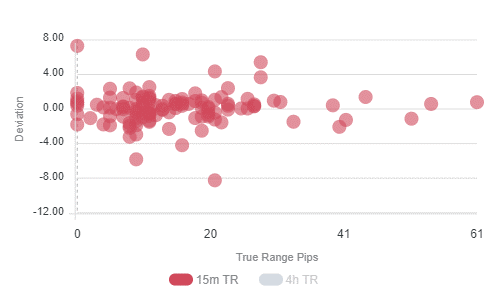

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 3 and 30 pips in deviations up to 3.0 to -4.2, although in some cases, if notable enough, a deviation can fuel movements of up to 60 pips.

How could affect EUR/USD?

EUR/USD remains in a range below 1.2200, with the euro bulls awaiting encouraging German IFO numbers for a sustained break above the latter. US stimulus hopes-driven market optimism weighs on the safe-haven dollar, keeping the buoyant tone intact around the major.

Should the survey disappoint, the immediate support awaits Friday’s low of 1.2151. Further south, the 50-DMA at 1.2125 could rescue the EUR bulls. Alternatively, a break above the 1.2200 level could call for a test of the January 13 high of 1.2224.

Key notes

EUR/USD Forecast: Bullish bias remains amid hopes for more US fiscal stimulus

Europe set to open slightly higher, as US fiscal talks get underway

EUR/USD could gain momentum if it clears 1.2200

About the German IFO Business Climate

This German business sentiment index released by the CESifo Group is closely watched as an early indicator of current conditions and business expectations in Germany. The Institute surveys more than 7,000 enterprises on their assessment of the business situation and their short-term planning. The positive economic growth anticipates bullish movements for the EUR, while a low reading is seen as negative (or bearish).