NZD/USD Price Analysis: Sellers pause around 0.6000 after more than 1.0% fall on RBNZ day

- NZD/USD remains on the back foot after RBNZ.

- The RBNZ held OCR steady at 0.25% but expanded QE, policymakers spoke dovish.

- A five-week-old support line on the bears’ radar below 0.6000.

- 61.8% Fibonacci retracement, April high can lure buyers on the upside.

Having dropped over 1.0% following the RBNZ’s dovish appearance, NZD/USD bears catch a breath around 0.6000, down 1.15% on a day, ahead of the European open on Wednesday.

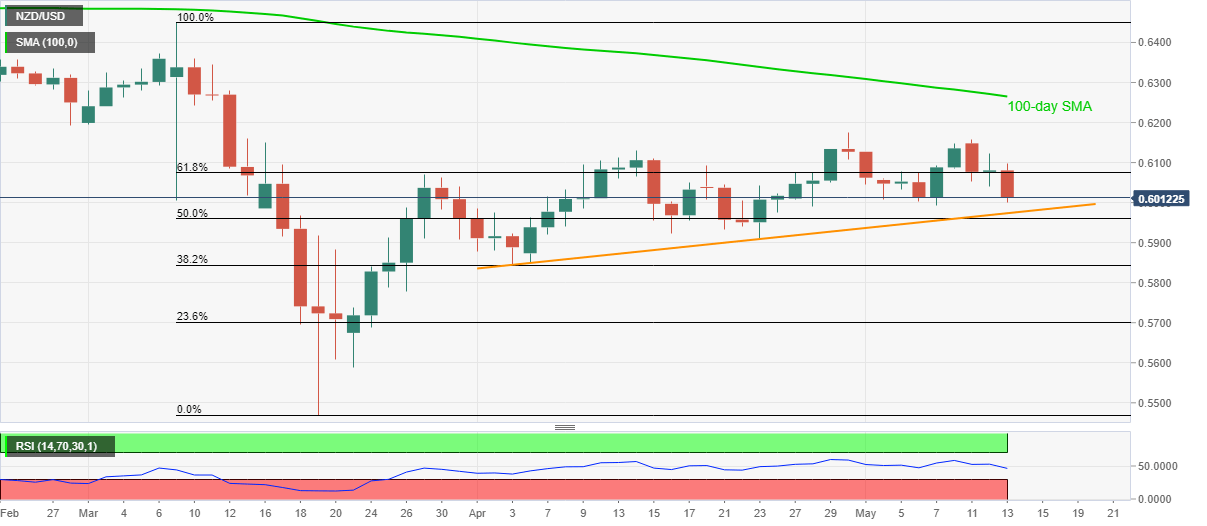

While the expansion of Quantitative Easing (QE) and fears of negative rates offer fundamental weakness to the pair, it’s a break below 61.8% Fibonacci retracement of March month fall keeps technical analysis in favor of the sellers.

Even so, a sustained break below 0.6000 will be needed for the further downside towards a multi-day-old support line, near 0.5970.

Though, pair’s weakness past-0.5970 might not hesitate to challenge 50% Fibonacci retracement and April low, respectively around 0.5960 and 0.5910.

On the contrary, a daily closing beyond 61.8% Fibonacci retracement level of 0.6075 can renew buying pressure towards April month high surrounding 0.6175. Additionally, 100-day SMA near 0.6265 can please the bulls after 0.6175.

NZD/USD daily chart

Trend: Pullback expected