WTI trims Asian session gains, June contract still up over 3%

- WTI struggles to hold onto recovery gains from the multi-year low.

- Comments from US President Trump, output cut from Russian oil giant and options positions favor the pullback.

- Risk aversion, barriers to demand keep the buyers under check.

WTI’s Asian session gains seem to be pressure ahead of the European session as the energy benchmark’s June contract drops from $22.51 to 21.50% by the press time. Even so, the black gold registers over 3.0% gains, 3.3% to be exact, on a day.

Although short-covering can be considered as the major catalyst for the recent pullback, traders might also have followed price-positive signals from Saudi Arabia and the US to portray the early-day gap-up.

The moves then got additional support from the news that the Russian oil giant is considering an output cut while Jason Kenney also called for oil majors to get together and save the oil-dependent economy. Also could have favored the recovery moves might be the option positions.

Alternatively, the risk-aversion wave, amid the coronavirus carnage, coupled with the Goldman Sachs call of further weakness, keeps weighing on the black gold.

Among the risk-averse catalyst, US President Trump’s threat to temporarily ban immigration into the US and concerns about the health of the North Korean leader Kim Jong-un seems to gain attention off-late.

For the session to come, oil traders are likely to keep eyes on any news concerning the supply restrictions from the majors for fresh impetus. Though, weekly oil stock data, for the period ended on April 17, from the American Petroleum Institute (API), prior 13.143M, could also offer second-tier clues for the energy benchmark.

Technical analysis

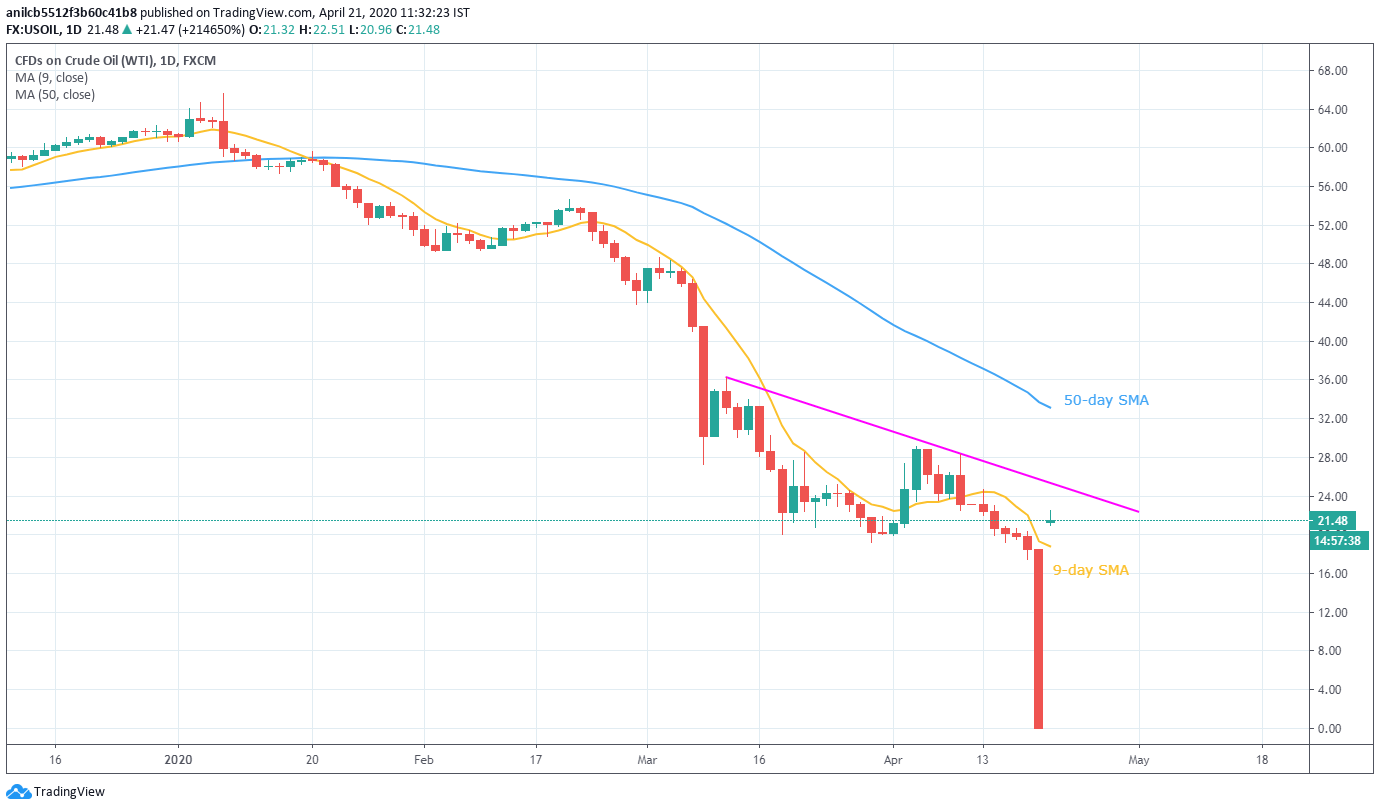

While sustained trading beyond 9-day SMA pushes the quote towards a six-week-old falling trend line, near $25.20, 50-day SMA near $33.15 could lure the buyers afterward. On the downside, a clear break below the 9-day SMA level of $18.80 should trigger a fresh downside.

Trend: Bearish