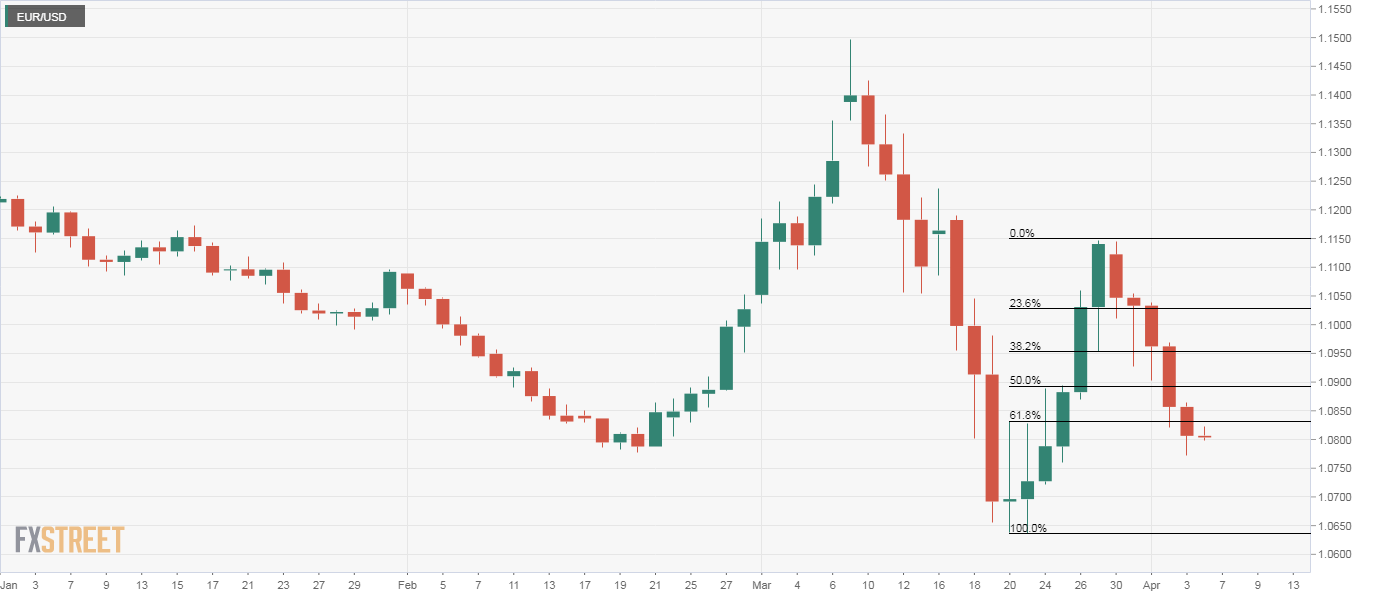

EUR/USD Price Analysis: Bears take out 61.8% Fib support

- EUR/USD closed under key Fibonacci support on Friday.

- The pair risks falling to recent lows near 1.0630 in the short-term.

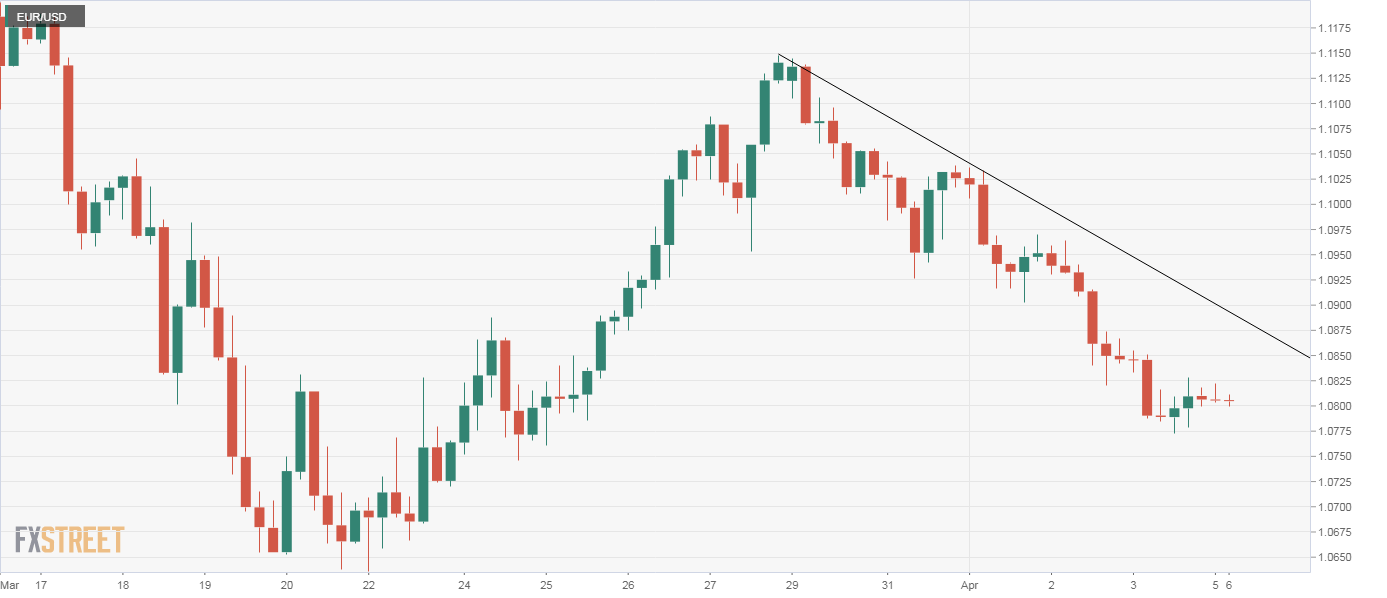

- A descending trendline hurdle is a level to beat for the bulls.

EUR/USD closed in the red for the fifth straight day on Friday, extending the sell-off from the March 27 high of 1.1148.

More importantly, the bears established a strong foothold under 1.0831, which is the 61.8% Fibonacci retracement of the rally from 1.0636 to 1.1148, with a weekly close under the key support.

At press time, the pair is trading largely unchanged on the day near 1.0805, having faced rejection at 1.0822 a few hours ago.

The path of least resistance is to the downside. A violation at Friday's low of 1.0773 would bolster the bearish setup and expose the March low of 1.0636.

The bearish bias would be invalidated if the trendline falling from recent highs is breached. As of writing, that trendline resistance is located near 1.09.

Daily chart

4-hour chart

Trend: Bearish