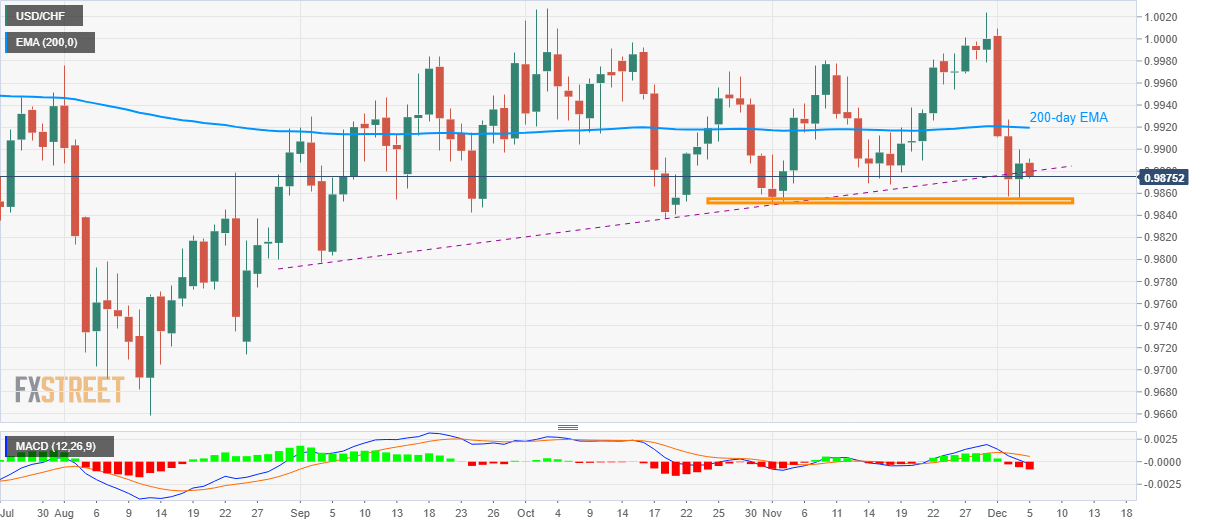

USD/CHF Technical Analysis: 0.9855/50 caps immediate downside

- USD/CHF seesaws around a three-month old rising trend-line.

- Bearish MACD, failure to carry the latest bounce keep sellers hopeful.

- Buyers will look for entry beyond 200-day EMA.

USD/CHF declines to an intra-day low of 0.9874 by the press time of the pre-European session on Thursday. Even so, the pair stays above near-term key horizontal-support.

While the pair’s failure to extend Wednesday’s pullback well beyond the three-month-old rising support line portrays the underlying momentum weakness, 12-bar Moving Average Convergence and Divergence (MACD) indicator flashes bearish signals and lures the sellers.

However, multiple lows marked since November 01 offers immediate key support around 0.9855/50, a break of which could fetch prices to September month low near 0.9800.

On the flip side, 200-day Exponential Moving Average (EMA) around 0.9920 acts as adjacent resistance that holds the gate for pair’s further recovery towards 0.9950 and November 08 top of 0.9980.

If at all the Bulls manage to rein prices beyond 0.9980, the October month high close to 1.0030 will be in focus.

USD/CHF daily chart

Trend: Pullback expected