Back

4 Dec 2019

US Dollar Index price analysis: DXY challenging 200 DMA, remains highly vulnerable to the downside

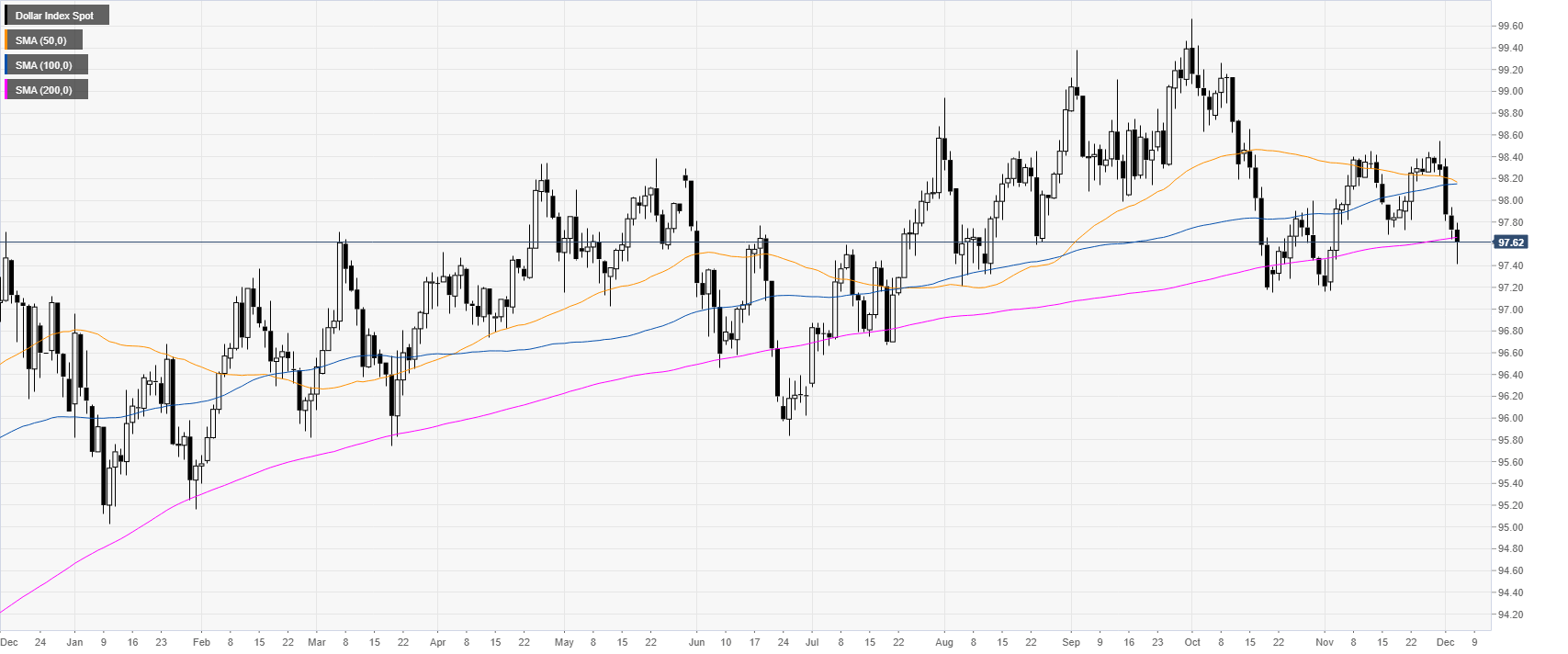

- DXY is under heavy pressure below the 97.70 level and the 200 DMA.

- The 97.20 support level is on the bears’ radar in the medium term.

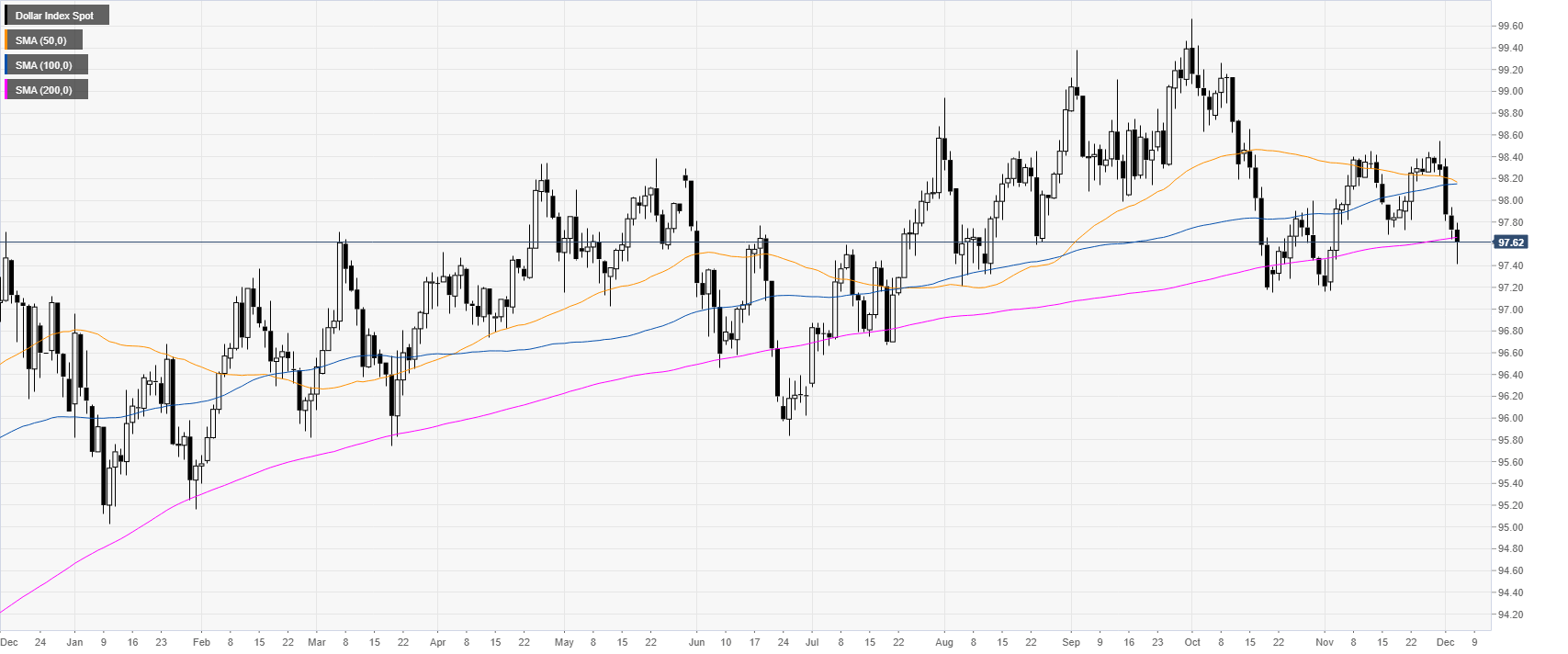

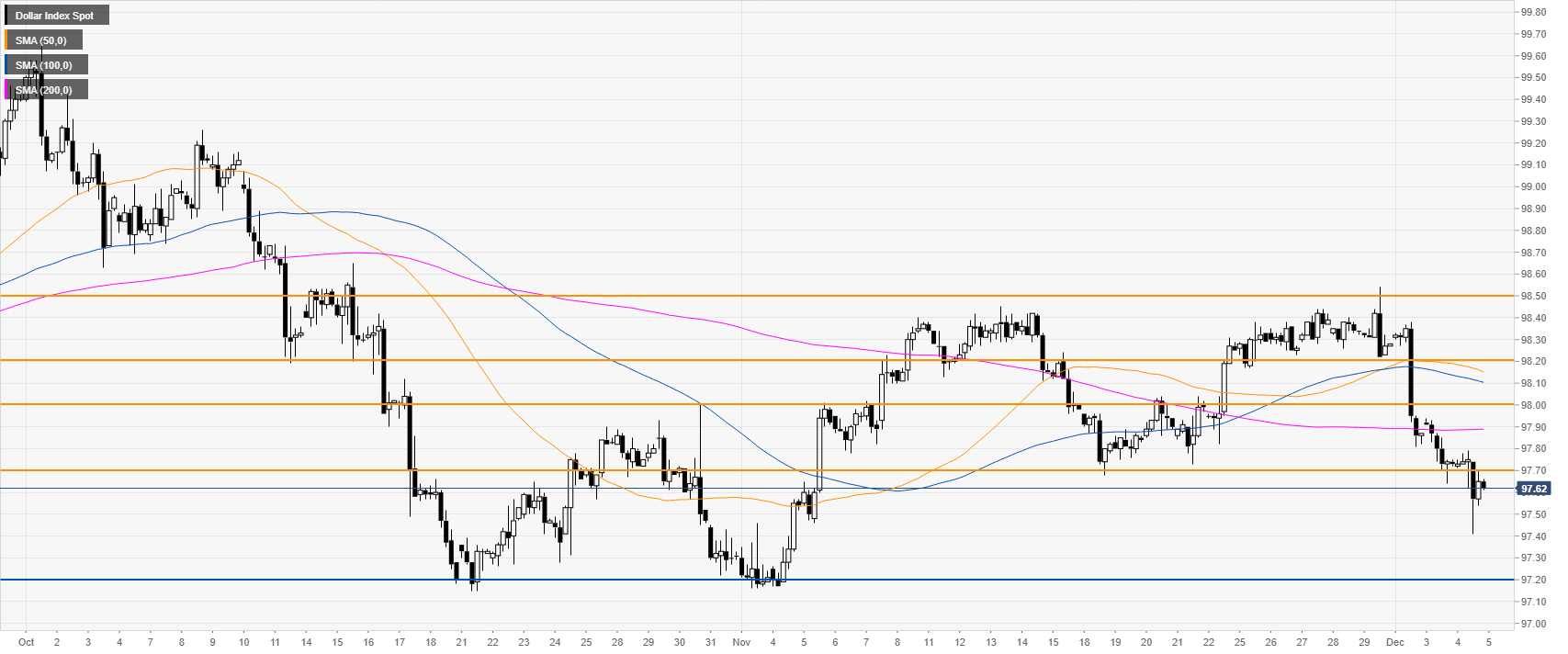

DXY daily chart

DXY (US Dollar Index) is trading in a bull trend as it is challenging the 200-day simple moving average (DMA). However, DXY is becoming increasingly weak and at risk of a selloff.

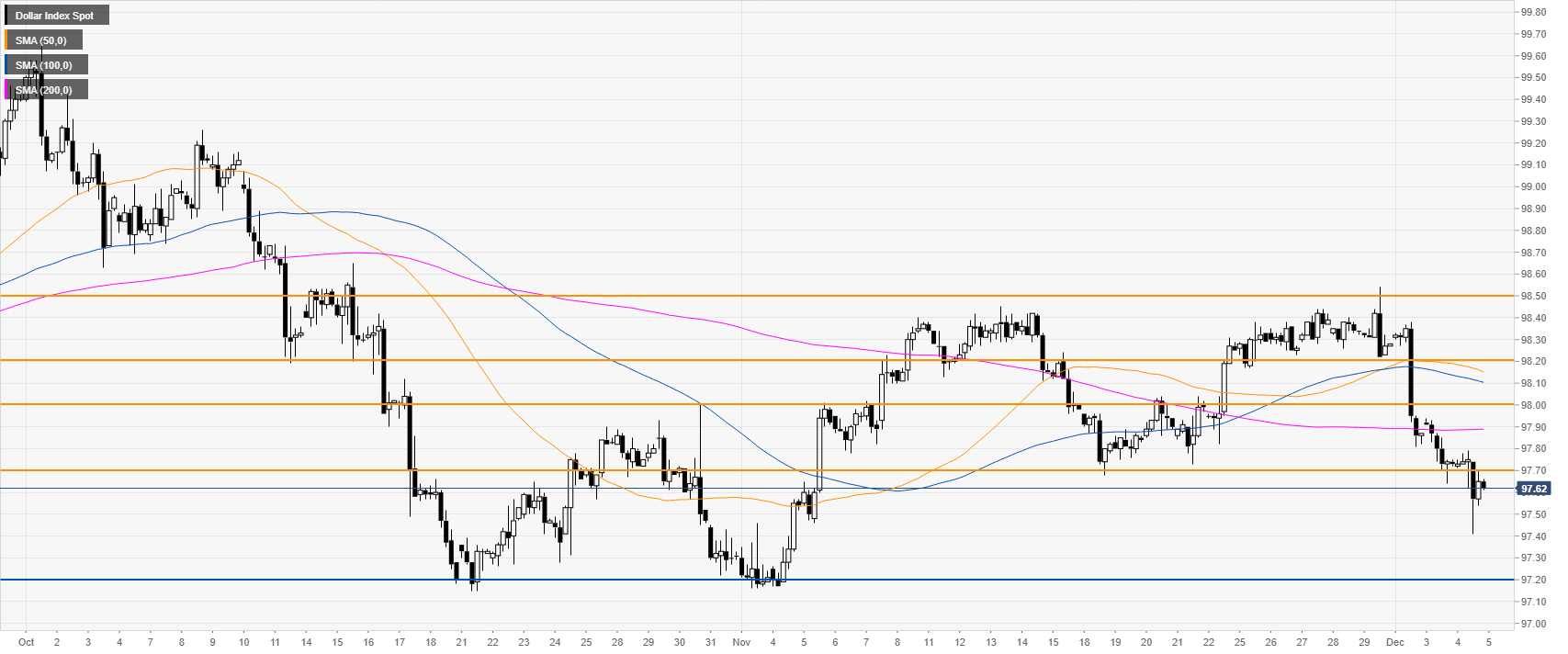

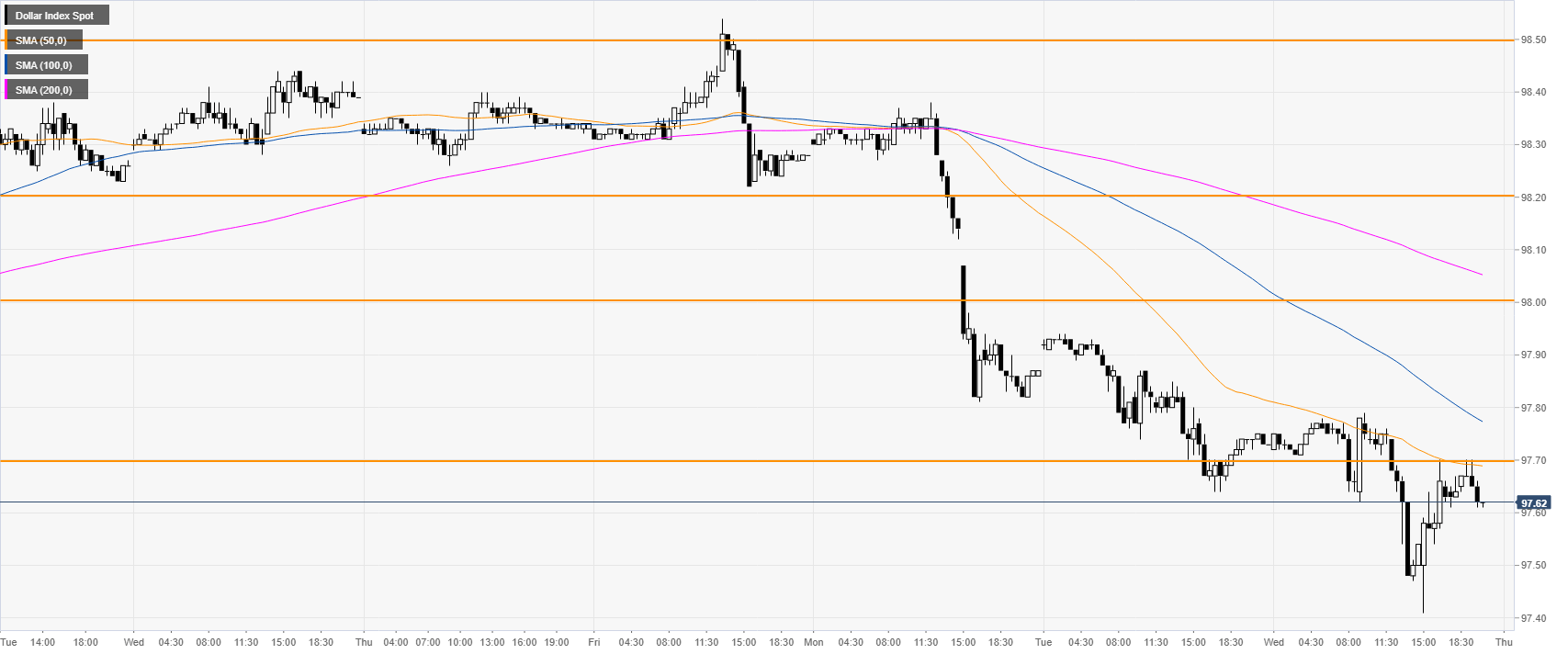

DXY four-hour chart

DXY broke below a critical support at the 97.70 level while trading below the main SMAs. At this stage, it seems that it is too late for bulls to intervene as a decline towards the 97.20 support level seems virtually inevitable.

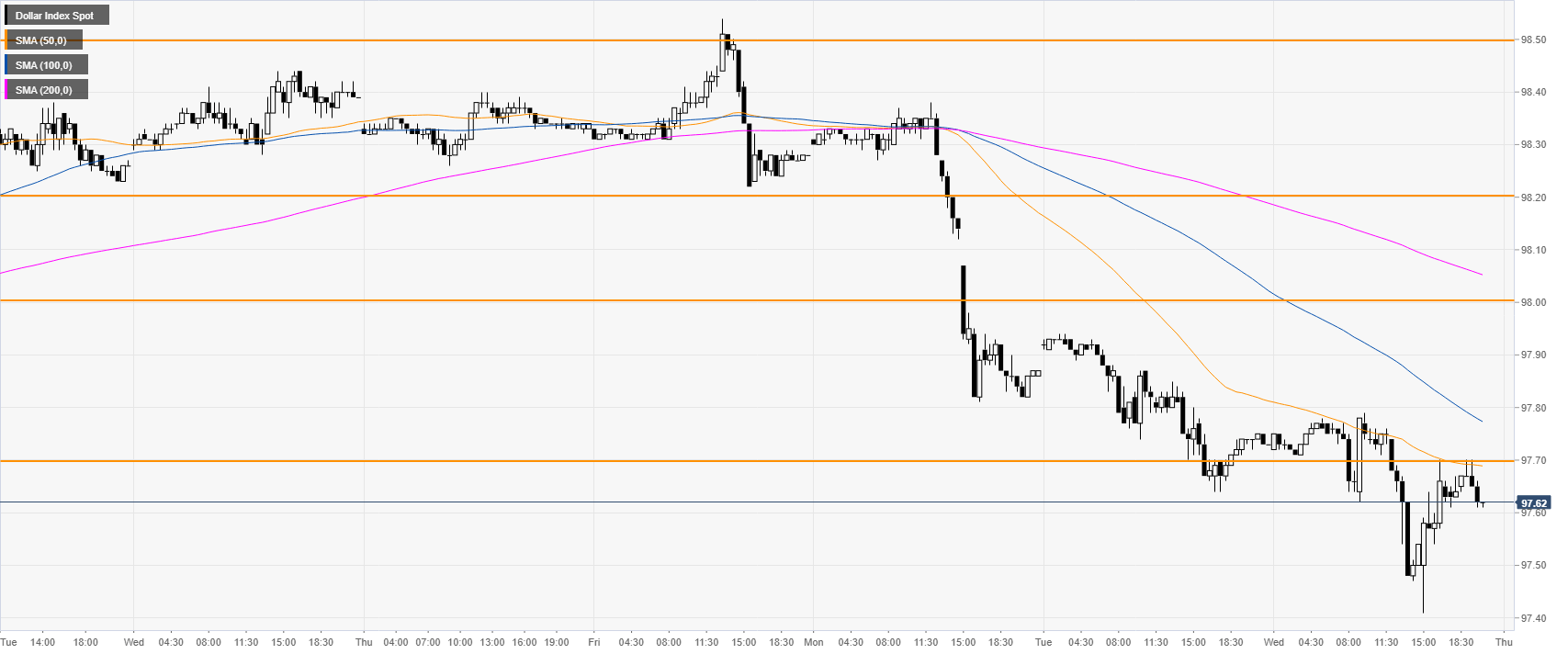

DXY 30-minute chart

The greenback is under pressure below its main SMAs. Resistance can be seen near the 97.70 and 98.00 levels.

Additional key levels