Back

23 Jul 2019

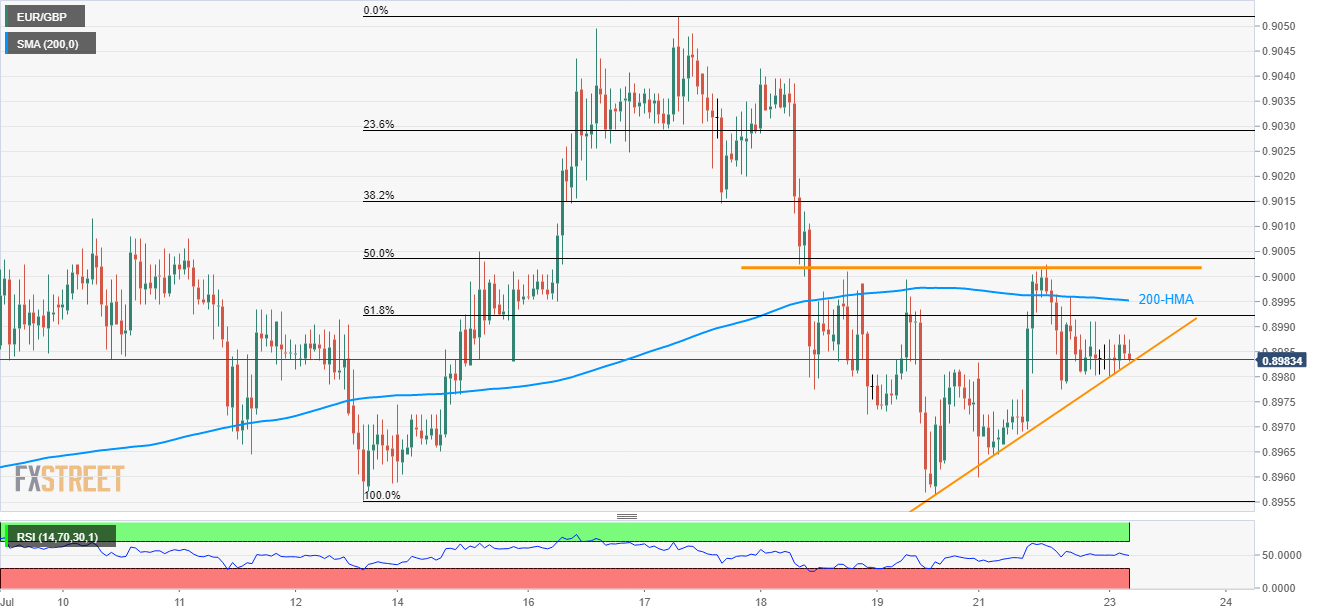

EUR/GBP technical analysis: 200-HMA can limit immediate rise inside ascending triangle

- Nearby key resistances to question EUR/GBP recovery from mid-month bottom.

- A downside break of pattern support could exert fresh selling pressure.

Despite repeated failures to slip beneath 2-day long rising support-line, EUR/GBP upside is likely to be tamed by short-term key resistances as it takes the rounds to 0.8980 ahead of the European open on Tuesday.

The first one being 200-hour moving average (HMA) level of 0.8995, close to the rising triangle’s upper-line at 0.9000 round-figure.

Should prices rally beyond 0.9000, 38.2% Fibonacci retracement level of 0.9015 and July 17 high around 0.9050 can please the bulls.

Though, a downside break of 0.8980 comprising pattern support might not hesitate to drag the quote to 0.8955 whereas 0.8900 round-figure could be on the bears’ radar then after.

EUR/GBP hourly chart

Trend: Pullback expected