USD/JPY technical analysis: Greenback can consolidate further up above 107.71 resistance

- USD/JPY is correcting up after a drop to the 107.00 support.

- The level to beat for bulls is 107.71 followed by 108.23 resistance.

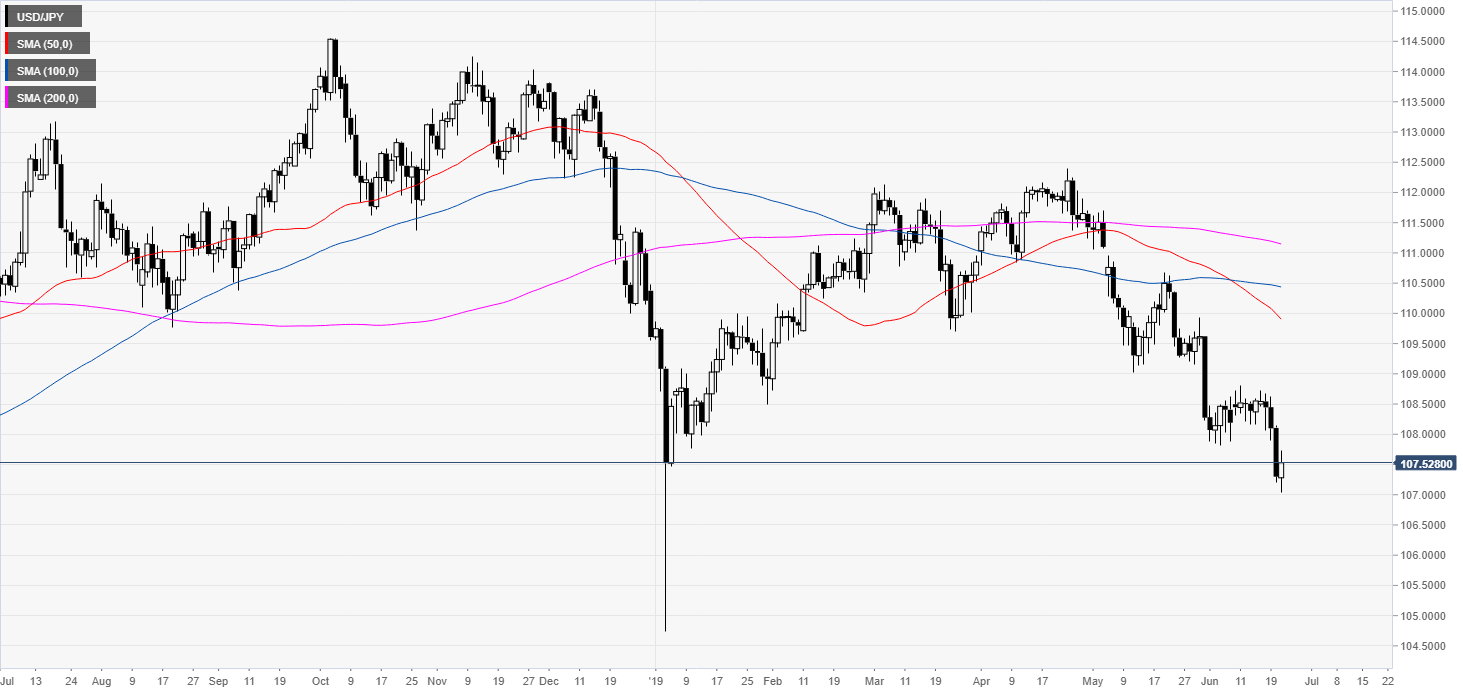

USD/JPY daily chart

USD/JPY is in a bear trend below its main daily simple moving averages (DSMAs). The 50 DSMA has crossed below the 100 DSMA which investors can see as a bearish clue. USD/JPY broke below the 107.81 swing low and almost reached the 107.00 handle.

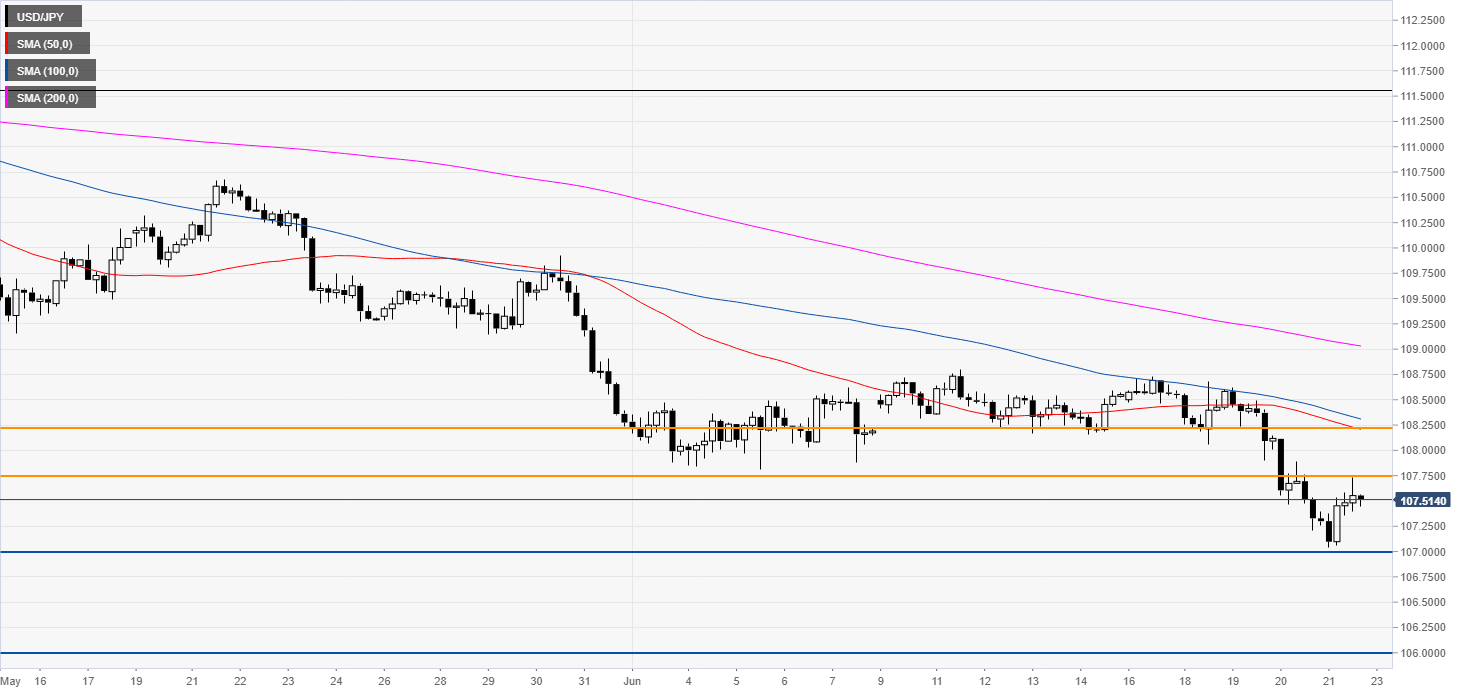

USD/JPY 4-hour chart

USD/JPY is trading below its main SMAs suggesting bearish momentum in the medium term. The market found support at the 107.00 figure and is currently in a correction up.

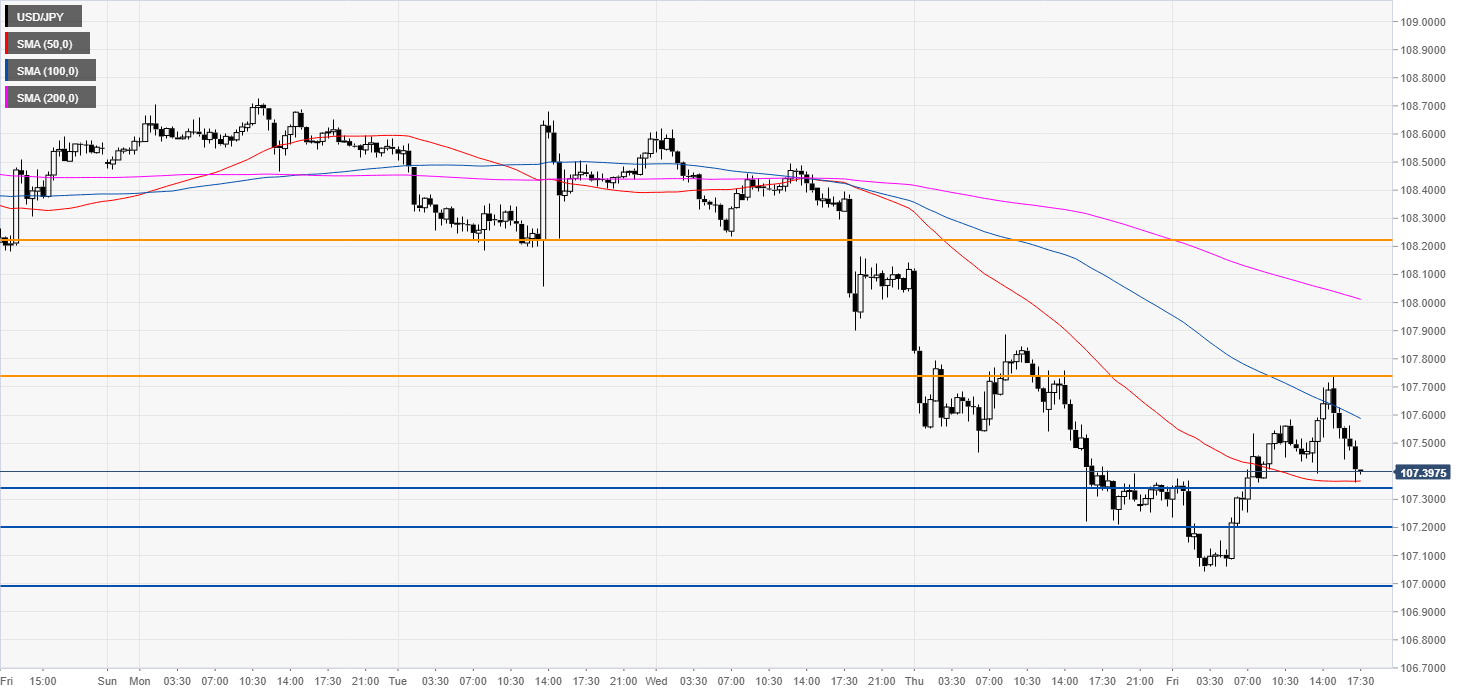

USD/JPY 30-minute chart

USD/JPY has reclaimed the 50 and 100 SMAs suggesting a potential bullish correction in the near term. The market can oscillate towards 107.35 and 107.20 support (previous day low) however a break above 107.71 (current Friday high) could open the doors to 108.23 strong resistance according to the Technical Confluences Indicator. On the flip side, a break below 107.00 on a daily closing basis would see the main bear trend resuming and open the doors for a potential drop to 106.00 figure.

Additional key levels