Gold technical analysis: Jumps to session tops on US-China trade headlines, bulls likely to target $1300 mark

• The prevailing risk-off environment, triggered by escalating US-China trade tensions helped the precious metal to stall its intraday slide near a one-week-old ascending trend-line.

• The commodity is now headed towards the top end of its daily trading range after China announced retaliatory tariffs on $60 billion worth of US goods starting June 1st.

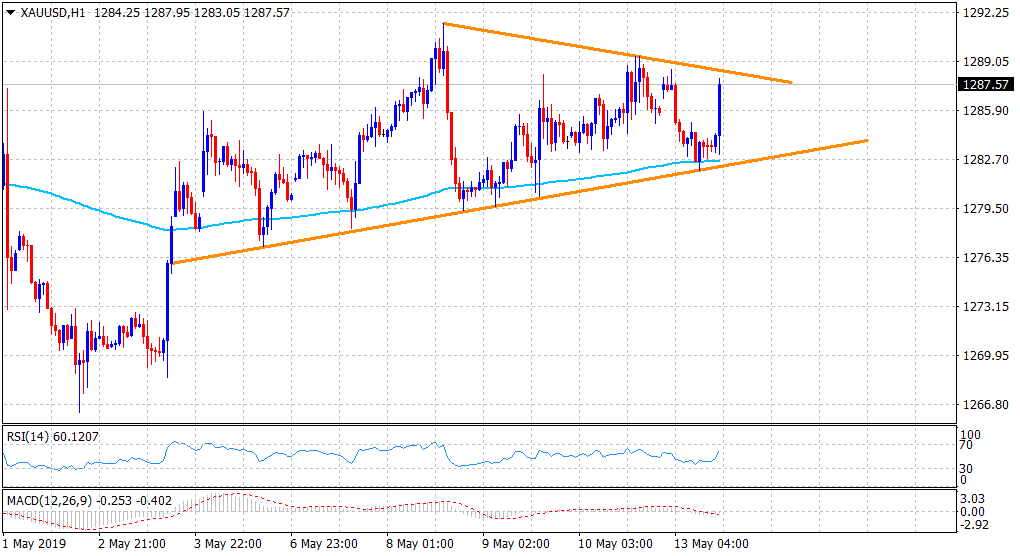

Meanwhile, the mentioned trend-line coincides with 200-hour EMA, which along with another descending trend-line resistance seemed to constitute towards the formation of a symmetrical triangle on hourly charts.

Adding to this, technical indicators on hourly/daily charts maintained their bullish bias and support prospects for an eventual bullish breakout, assisting the commodity to build on its recent bounce from four-month lows.

Bullish traders, however, are likely to wait for a sustained break through the descending trend-line hurdle before positioning for any further appreciating move towards reclaiming the key $1300 psychological mark.

Gold 1-hourly chart