NZD/USD Technical Analysis: 0.6700 back in focus now

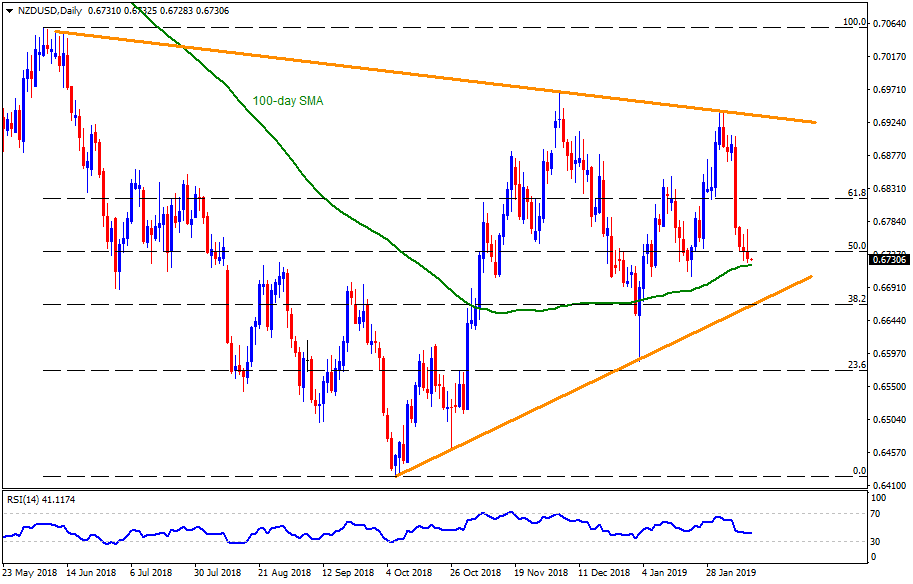

NZD/USD daily chart

- The NZD/USD pair trades around 0.6730 at the start of Tuesday’s Asian trading.

- The 100-day simple moving average (SMA) near 0.6720 can offer immediate support to the pair’s decline prior to highlighting the 0.6700 round-figure.

- However, an upward sloping trend-line connecting lows since October 2018, at 0.6660 now, could limit the pair’s downside past 0.6700.

- On the upside, the 0.6775 and the 61.8% Fibonacci Retracement of its June-October downturn, at 0.6815, seem crucial resistances to watch.

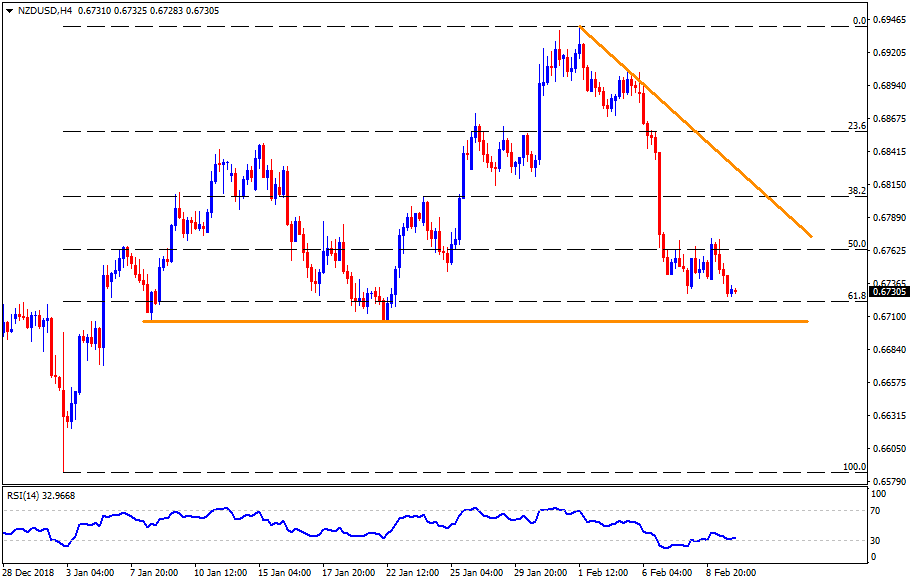

NZD/USD 4-Hour chart

- While 100-day SMA offers immediate support on D1, the H4 chart clearly portrays the importance of 0.6705-0.6700 support area connecting the lows marked in January 08 and 22.

- Should the pair drops under 0.6700, the 0.6670 and 0.6620 may offer additional supports other than 0.6660 conveyed on daily chart.

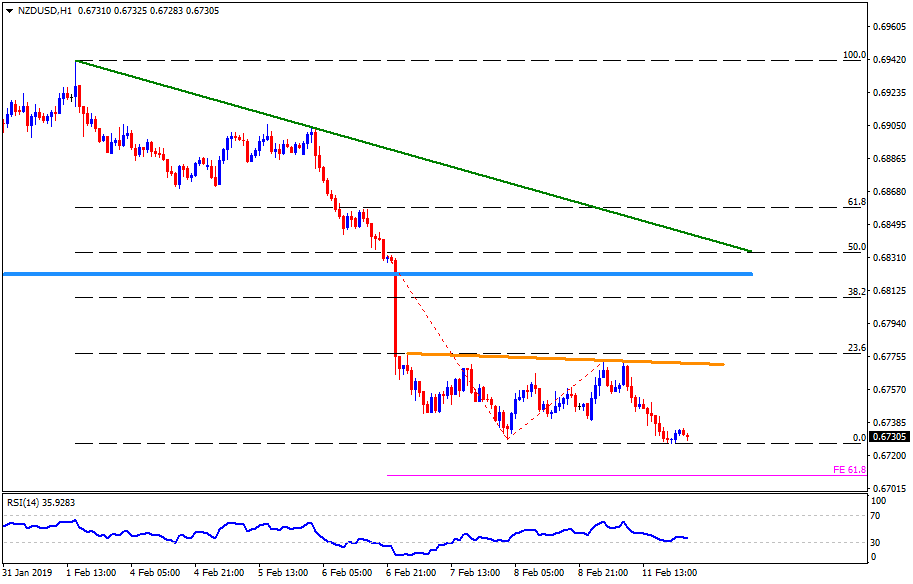

NZD/USD hourly chart

- On H1, prices can avail 0.6725 as adjacent rest before slipping to 0.6710 level including 61.8% Fibonacci expansion of its recent slump.

- Meanwhile, the 0.6740 and the descending trend-line figure of 0.6770 can restrict the pair’s nearby upside.

Additional Important Levels:

NZD/USD

Overview:

Today Last Price: 0.6732

Today Daily change: -0.0017 pips

Today Daily change %: -0.25%

Today Daily Open: 0.6749

Trends:

Daily SMA20: 0.6813

Daily SMA50: 0.6799

Daily SMA100: 0.6724

Daily SMA200: 0.6757

Levels:

Previous Daily High: 0.6767

Previous Daily Low: 0.6729

Previous Weekly High: 0.6907

Previous Weekly Low: 0.6729

Previous Monthly High: 0.694

Previous Monthly Low: 0.6516

Daily Fibonacci 38.2%: 0.6744

Daily Fibonacci 61.8%: 0.6752

Daily Pivot Point S1: 0.673

Daily Pivot Point S2: 0.671

Daily Pivot Point S3: 0.6692

Daily Pivot Point R1: 0.6768

Daily Pivot Point R2: 0.6786

Daily Pivot Point R3: 0.6806