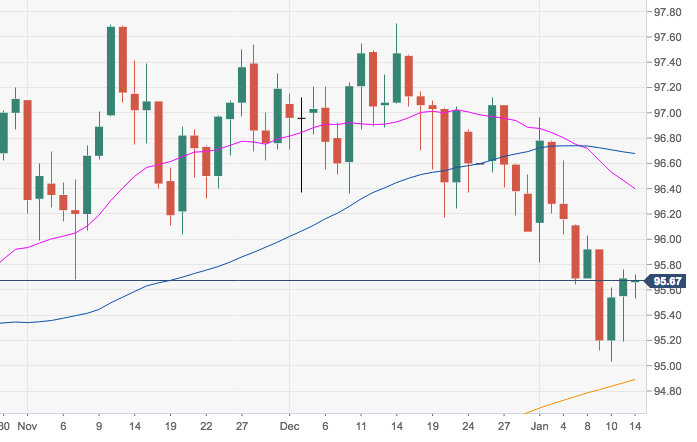

US Dollar Index Technical Analysis: A potential test to the 200-day SMA at 94.91 remains on the cards

- DXY is struggling for direction on Monday, looking to prolong the positive momentum for the third session in a row following late last week’s gains.

- However, the resumption of the recent downtrend remains a possibility, and with it the likeliness of a re-visit to the critical 200-day SMA at 94.91 ahead of September lows in the 93.80 area.

- On the other hand, downside pressure should mitigate on a surpass of the 95.88/96.00 band.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 95.66

Today Daily change: -3.0 pips

Today Daily change %: -0.0314%

Today Daily Open: 95.69

Trends:

Previous Daily SMA20: 96.44

Previous Daily SMA50: 96.69

Previous Daily SMA100: 96

Previous Daily SMA200: 94.86

Levels:

Previous Daily High: 95.76

Previous Daily Low: 95.19

Previous Weekly High: 96.12

Previous Weekly Low: 95.03

Previous Monthly High: 97.71

Previous Monthly Low: 96.06

Previous Daily Fibonacci 38.2%: 95.54

Previous Daily Fibonacci 61.8%: 95.41

Previous Daily Pivot Point S1: 95.33

Previous Daily Pivot Point S2: 94.98

Previous Daily Pivot Point S3: 94.76

Previous Daily Pivot Point R1: 95.9

Previous Daily Pivot Point R2: 96.12

Previous Daily Pivot Point R3: 96.47