USD/JPY challenges the 108.00 support, session lows

- The pair drops and tests the key support at the 108.00 handle.

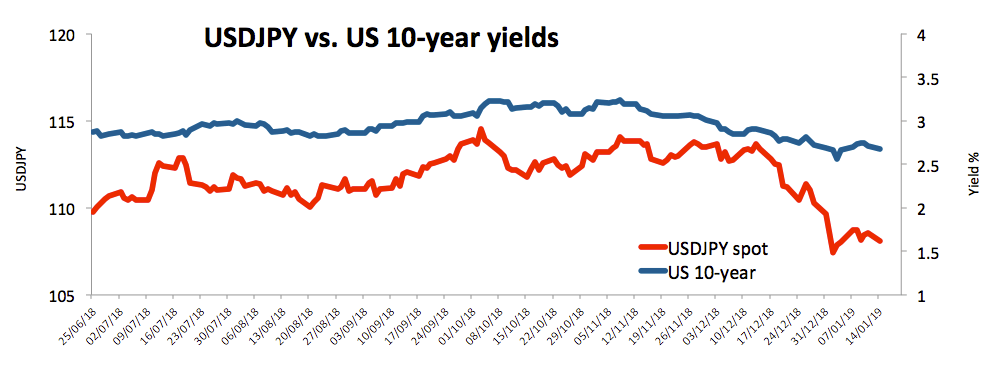

- The downside in spot tracks declining US yields.

- US futures are on the defensive amidst risk-off sentiment.

The Japanese safe haven is gathering extra steam on Monday and is now dragging USD/JPY to the area of daily lows in the 108.00 neighbourhood.

USD/JPY looks to yields for direction

Spot remains depressed at the beginning of the week, now trading in the lower end of the daily range in the boundaries of the 108.00 handle following a leg lower in US yields.

In fact, yields of the US 10-year note opened with a gap lower although they appear to have found some decent support in the 2.66% area for the time being.

Sentiment in the global markets turned sour early in the day following poor results from the Chinese trade figures, where exports and imports unexpectedly contracted and added to the view that a slowdown in the domestic economy could be in the offing.

In the data space, the next relevant data will be tomorrow’s publication of December’s Producer Prices and the Philly Fed manufacturing index.

USD/JPY levels to consider

As of writing the pair is losing 0.46% at 108.09 facing the next support at 107.7 (low Jan.10) seconded by 107.51 (low Jan.4) and then 105.00 (2019 low Jan.2). On the other hand, a breakout of 108.53 (10-day SMA) would open the door to 109.08 (high Jan.8) seconded by 110.26 (21-day SMA).