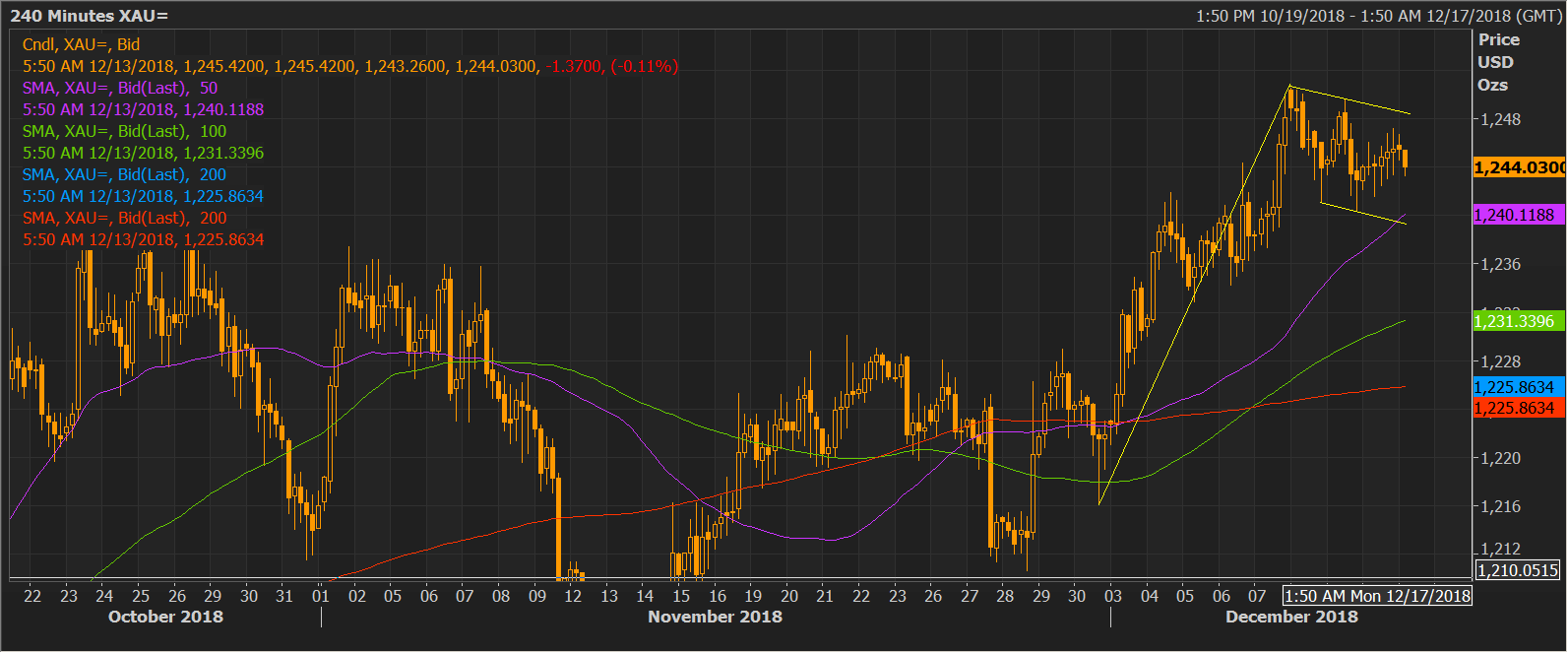

Gold Technical Analysis: yellow metal has formed a bull flag

- Gold has created a classic bull flag - a continuation pattern - on the 4-hour chart.

- A convincing break above $1,248 (upper end of the flag) would signal a continuation of the rally from the low of $1,216 and would open the doors to $1,280 (target as per the measured height method - pole height added to breakout price).

- That target may not look feasible for now. That said, the flag breakout could yield a rally to the 200-day moving average (MA), which is currently located at $1,256.

- The key moving averages (50, 100, and 200) are trending north and located one above the other, indicating the path of least resistance is to the higher side. So, the prospects of the bullish breakout are high.

4-hour chart

Trend: Bullish

XAU/USD

Overview:

Today Last Price: 1244.69

Today Daily change: -1.2e+2 pips

Today Daily change %: -0.0947%

Today Daily Open: 1245.87

Trends:

Previous Daily SMA20: 1229.62

Previous Daily SMA50: 1225.61

Previous Daily SMA100: 1212.89

Previous Daily SMA200: 1231.76

Levels:

Previous Daily High: 1247.21

Previous Daily Low: 1242.1

Previous Weekly High: 1250.1

Previous Weekly Low: 1221.39

Previous Monthly High: 1237.4

Previous Monthly Low: 1196.4

Previous Daily Fibonacci 38.2%: 1245.26

Previous Daily Fibonacci 61.8%: 1244.05

Previous Daily Pivot Point S1: 1242.91

Previous Daily Pivot Point S2: 1239.95

Previous Daily Pivot Point S3: 1237.79

Previous Daily Pivot Point R1: 1248.02

Previous Daily Pivot Point R2: 1250.18

Previous Daily Pivot Point R3: 1253.14