GBP/JPY: Guppy under pressure as Brexit withdrawal draft freezes the mood

- Sterling looks vulnerable to Brexit-related jitters.

- The Bank of Japan says both wages and prices are still weak.

The GBP/JPY is currently trading at around 146.80 after losing about 250 pips on Wednesday on the back of the uncertainties related to the concrete shape of Brexit after the withdrawal draft was presented by the EU.

The grand narrative moving the Pound are tensions arising between the UK and the EU regarding the Brexit divorce treaty written by the EU which has been vehemently rejected by the UK officials.

The UK Prime Minister Theresa May is set to deliver a speech on Friday and hopefully provide some more light to the Brexit withdrawal plans.

Theresa May said that the EU draft text “would, if implemented, undermine the UK common market and threaten the constitutional integrity of the UK by creating a customs and regulatory border down the Irish Sea. No U.K. prime minister could ever agree to it.”

On the UK macro front, the set of manufacturing PMI was released on Thursday with activity in manufacturing slowing further in February according to the latest survey from IHS/Markit. The UK manufacturing Purchasing Managers' Index (PMI) decelerated to 55.2 in February, down from previous month’s reading of 55.3.

The next significant data for Yen is on Thursday with Tokyo core CPI expected to rise 1.4% over the year in February, up from the previous reading of 1.3% y/y.

The Bank of Japan Governor Kuroda said in Japan's parliament that despite solid economic growth, wages and prices are still relatively weak.

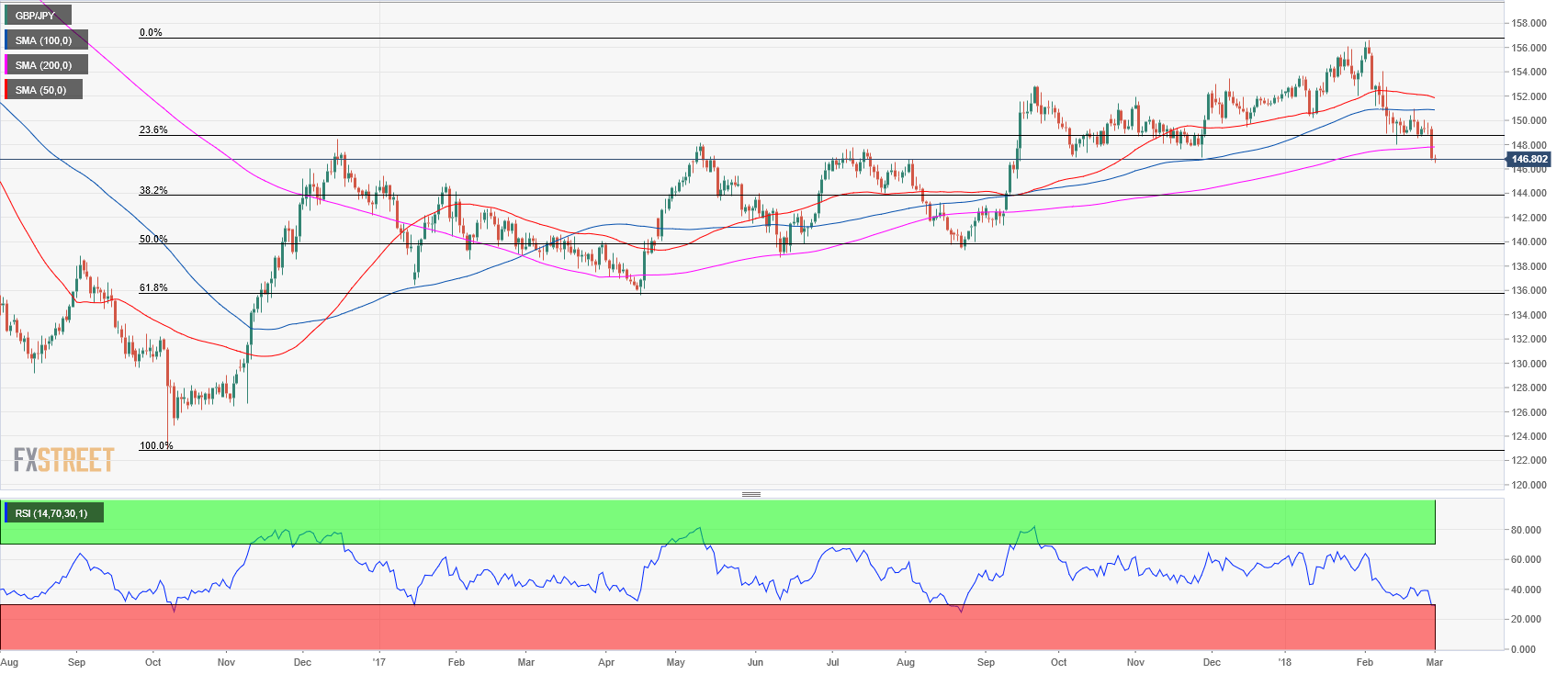

Technically the GBP/JPY has broken sharply below its 200-period simple moving average which is seen as a bearish configuration. The next key support is seen at 146.50 which is the 38.2% Fibonacci retracement from the October 2017-February 2018 bull run. Further down the 140.60 level should provide support as it is the 50% Fibonacci retracement from the October 2017-February 2018 bull run. To the upside, resistance is seen at the 149.00 figure which is also the minor 23.6% Fibonacci retracement. Further up the 100-period simple moving average should provide some dynamic resistance at 150.80.

GBP/JPY daily chart