GBP/JPY seeing some topside action, hurdles over 183.00

- The GBP/JPY caught a bounce on Monday as investors go risk-on.

- Tuesday sees UK labor and PMI data.

- Japan has a Tokyo CPI advance inflation reading to close out the week.

The GBP/JPY has reclaimed the 183.00 handle in Monday trading as broad-market risk flows turn risk-on, taking safe havens like the Japanese Yen (JPY) down and bolstering the relatively riskier Pound Sterling (GBP) into fresh highs.

The Guppy is trading into its highest bids in over a week, landing just north of the 183.00 handle at 183.28 before a relief pullback drags the pair back down.

The GBP will need all the help it can get this week: with a sedate Monday on the cards, Tuesday is set to kick things off with a bang.

Early Tuesday at 06:00 GMT sees UK Claimant Count Change and Employment Change numbers; markets expect the UK to see an uptick in people seeking jobless benefits to increase from 0.9K to 2.3K, while the number of employed people is expected to decline 198K, an improvement over the previous reading of -207K, but still in negative territory.

UK Purchasing Manager Index (PMI) figures are also on the docket for Tuesday at 08:30 GMT; both services and manufacturing components are expected to improve slightly, with the composite PMI for October expected to rise from 48.5 to 48.8.

On the Yen side, Japan's next round of inflation figures are due late Thursday at 23:30 GMT. The Core Tokyo Consumer Price Index (CPI) last showed an annualized 2.5% increase, and markets are forecasting that the CPI (minus volatile fresh food prices) will hold steady at that number, printing 2.5% for the year into October.

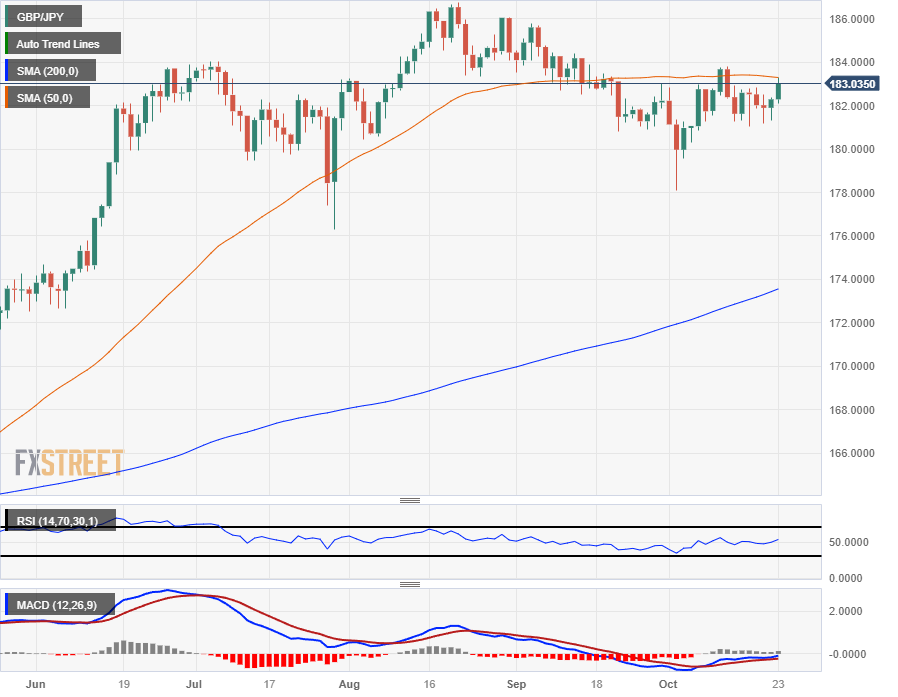

GBP/JPY Technical Outlook

The GBP/JPY is getting dragged back into the 50-day Simple Moving Average (SMA) on daily candlesticks as Monday's six-day high pins the Guppy into medium-term averages.

The next topside level to beat will be the last swing high 183.82 before bidders can re-challenge multi-year highs set back in August beyond the 186.00 handle.

The floor is priced in at the very low end of early October's unexpected plunge into 178.00, and the long-term outlook has the GBP/JPY firmly buried in the high end with the 200-day SMA leaning bullish, but far below current price action just beneath 174.00.

GBP/JPY Daily Chart

GBP/JPY Technical Levels