USD/JPY Price Analysis: Bulls could be about to step in again at prior resistance

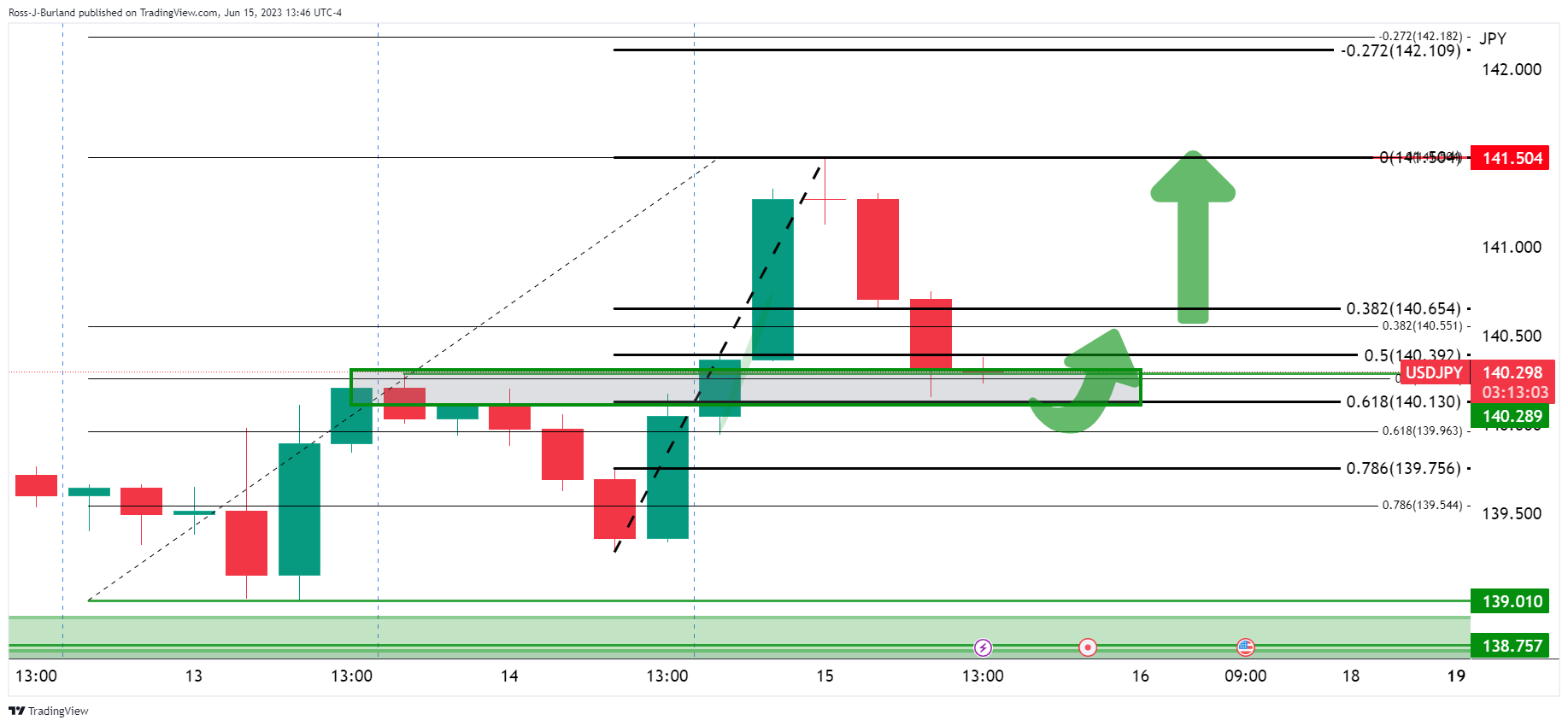

- USD/JPY bulls take a step back but eye higher highs.

- The price is meeting a prior area of resistance eyed as potential support.

USD/JPY has reached the highest levels since November 2022 as the US Federal Reserve maintained a hawkish stance in Wednesday's interest rate announcement with the dot plot hinting at two more quarter-point rate increases this year. However, a big wick is being left on the day's candle currently as the US Dollar and US Treasury yields pared gains. At the same time, investors digested the European Central Bank's interest rate hike and a flurry of economic data. Nevertheless, should support on the 4-hour charts hole, there will be prospects of a bullish extension in the coming sessions and days as the following analysis illustrates:

USD/JPY daily charts

USD/JPY H4 chart

The support on the 4-hour chart could be where the price is meeting old resistance that is aligned with the 50% mean reversion of the 4-hour bullish impulse.