Back

18 May 2023

Crude Oil Futures: Corrective knee-jerk on the table?

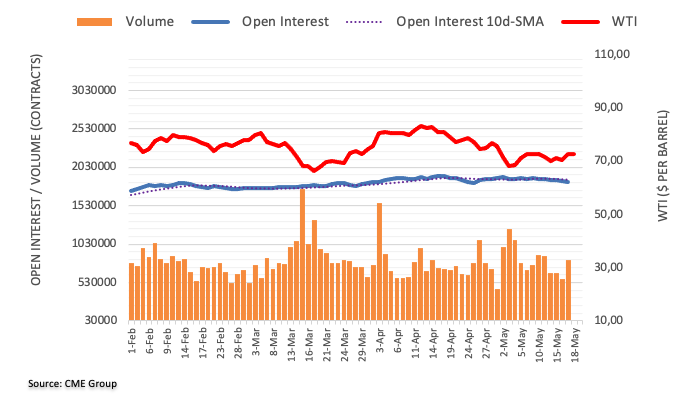

CME Group’s flash data for crude oil futures markets noted traders reduced further their open interest positions on Wednesday, this time by around 18.5K contracts. Volume, instead, remained erratic and went up by around 250.4K contracts.

WTI: Upside remains limited near $74.00

Wednesday’s marked advance in prices of the WTI was on the back of shrinking open interest, which is suggestive that extra gains appear not favoured for the time being. In the meantime, occasional bullish attempts in the commodity should meet initial hurdle around the $74.00 mark per barrel.